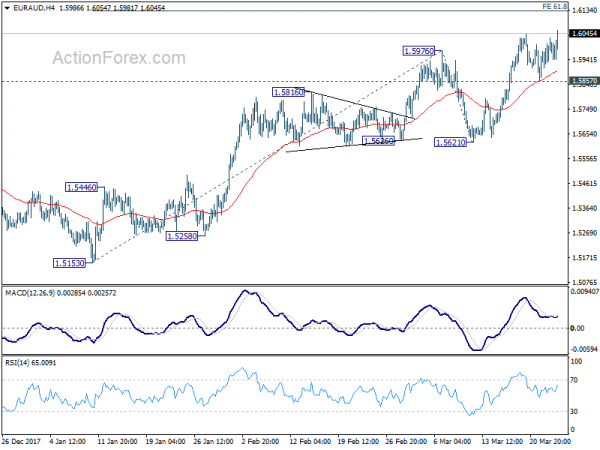

After some consolidations, EUR/AUD’s rally extended to as high as 1.6054 last week and closed strongly. Initial bias is back on the upside this week. Current rise would target 61.8% projection of 1.5130 to 1.5976 from 1.5621 at 1.6130 first. Break there will target 100% projection at 1.6444 next. On the downside, break of 1.5857 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

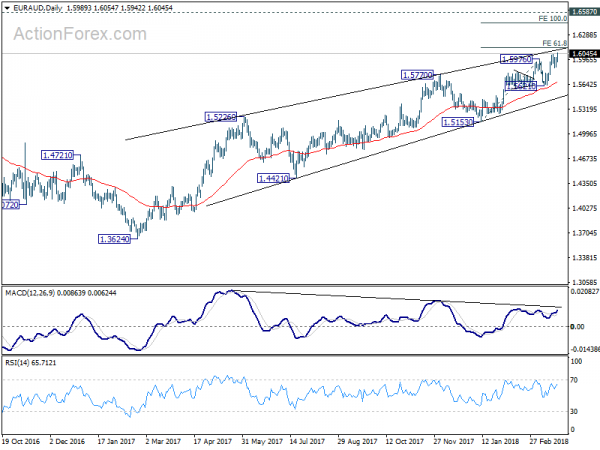

In the bigger picture, current development suggests that rise from 1.3624 is not completed yet. And it’s still in progress for 1.6587 key resistance level. We’d be cautious on strong resistance from there to limit upside, on bearish divergence condition in daily MACD. But for now, break of 1.5621 support is needed to be the first sign of medium term reversal. Otherwise, outlook will stays bullish even in case of deep pull back.

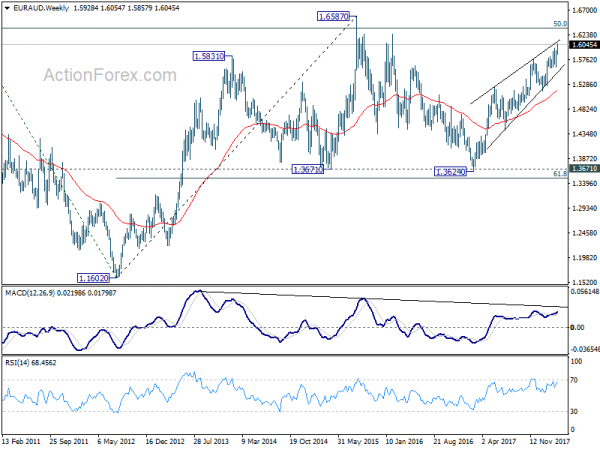

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should indicate long term reversal and target 1.1602 long term bottom again.