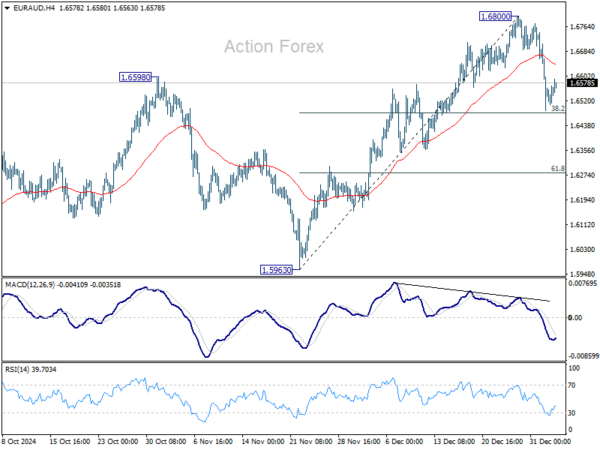

EUR/AUD’s deep retreat last week confirmed short term topping at 1.6800. Yet, it recovered just ahead of 38.2% retracement of 1.5963 to 1.6800 at 1.6480. Initial bias is turned neutral this week first. Risk is now mildly on the downside as long as 1.6800 resistance holds, in case of extended recovery. Firm break of 1.6480 will bring deeper correction 61.8% retracement at 1.6283.

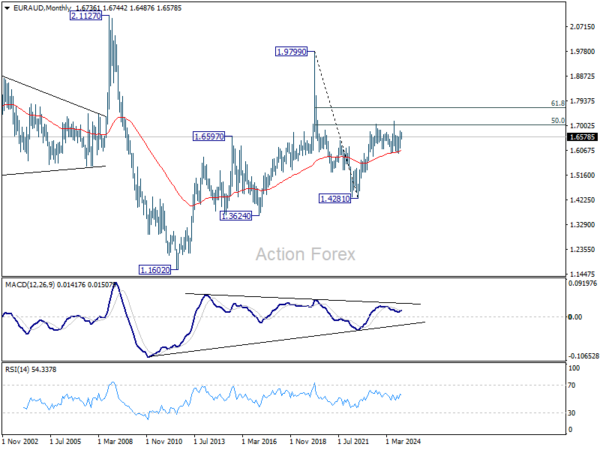

In the bigger picture, EUR/AUD is holding on to 1.5996 key support despite brief breach. Larger up trend from 1.4281 (2022 low) is still in favor to resume through 1.7180 at a later stage. Nevertheless, sustained break of 1.5995 will indicate that such up trend has completed and deeper decline would be seen.

In the longer term picture, rise from 1.4281 is seen as the second leg of the pattern from 1.9799 (2020 high), which is part of the pattern from 2.1127 (2008 high). As long as 55 M EMA (now at 1.6073) holds, this second leg could still extend higher. However, sustained trading below 55 M EMA will open up the bearish case for extending the decline through 1.4281 low.