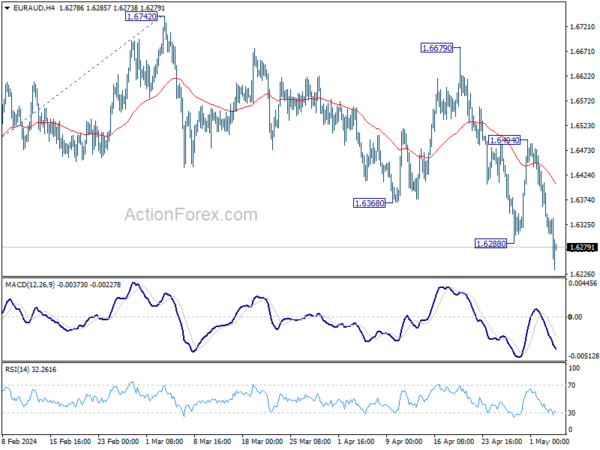

EUR/AUD’s fall from 1.6742 continued last week despite interim strong rebound. Initial bias stays on the downside this week. This decline is seen as the third leg of the corrective pattern from 1.7062. Further fall should be seen to expected to 1.6127 support, or further to 100% projection of 1.7062 to 1.6127 from 1.6742 at 1.5807. For now, risk will remain on the downside as long as 1.6494 resistance holds, in case of recovery.

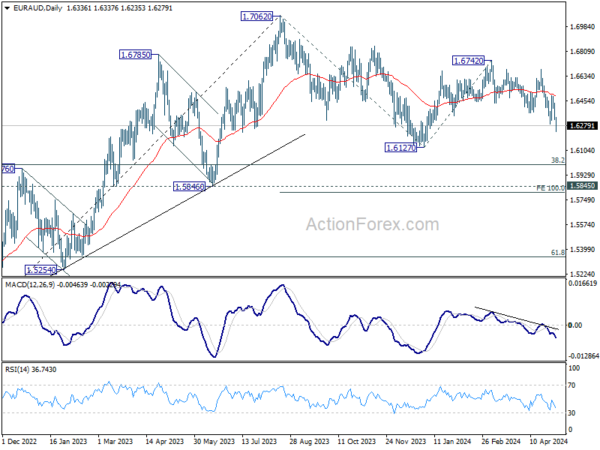

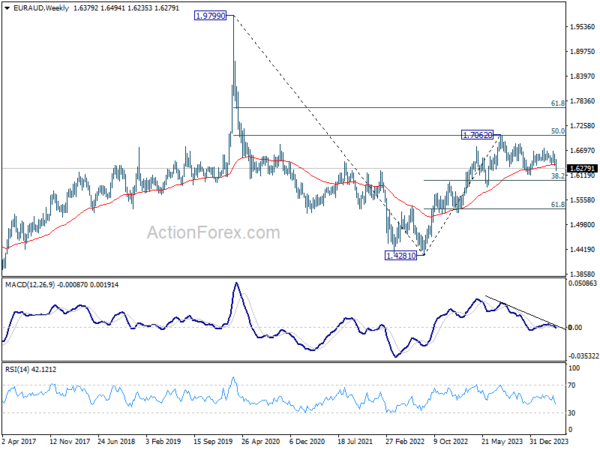

In the bigger picture, fall from 1.7062 medium term top is seen as a correction to the up trend from 1.4281 (2022 low). In case of deeper fall, strong support is expected around 1.5846 and 38.2% retracement of 1.4281 to 1.7062 at 1.6000 to bring rebound. Break of 1.7062 is in favor as a later stage.

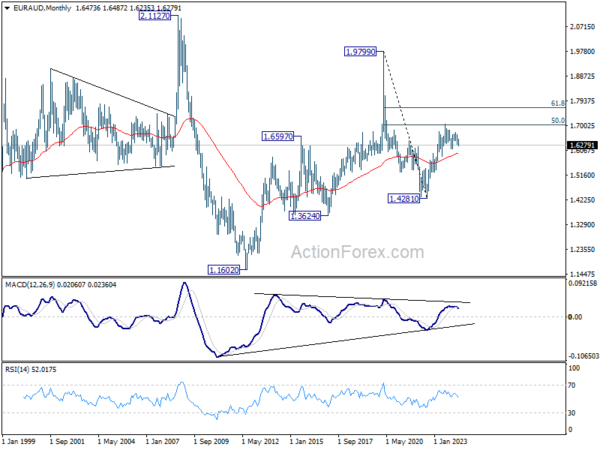

In the longer term picture, price actions from 1.9799 (2020 high) are seen as a long term decline at the same scale as the rise from 1.1602 (2012 low). Rebound from 1.4281 is seen as the second leg. As long as 55 M EMA (now at 1.5950) holds, this second leg could still extend higher. However, sustained trading below 55 M EMA will open up the bearish case for extending the decline through 1.4281 low.