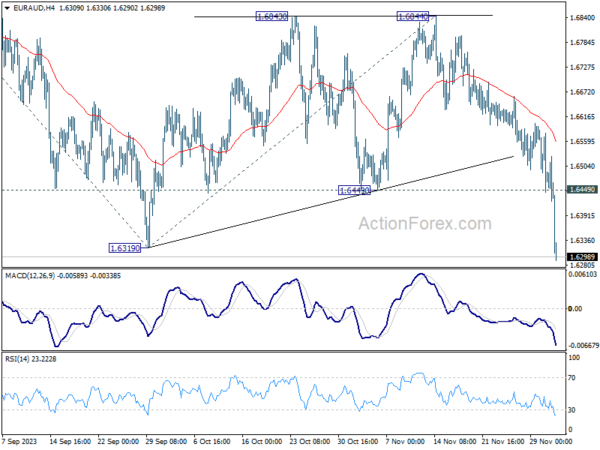

EUR/AUD’s decline from 1.7062 resumed by diving through 1.6319 support last week. Initial bias stays on the downside this week for 100% projection of 1.7062 to 1.6319 from 1.6844 at 1.6106 next. On the upside, above 1.6649 resistance will turn intraday bias and bring consolidations first, before staging another decline.

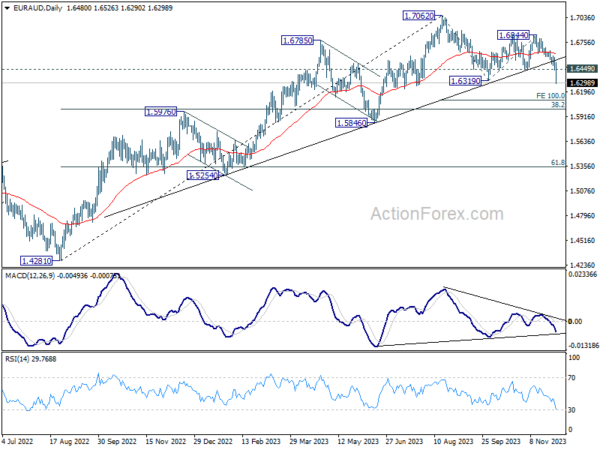

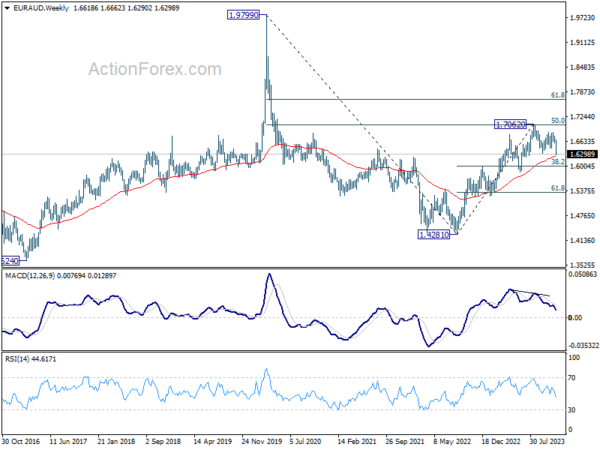

In the bigger picture, the break of medium term trend line support now suggests fall from 1.7062 correcting the whole up trend from 1.4281 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.4281 to 1.7062 at 1.6000. Strong support could be seen there to bring rebound on first attempt. But risk will stay on the downside as long as 1.6844 resistance holds. Sustained break of 1.6000 would bring further fall to 61.8% retracement at 1.5343.

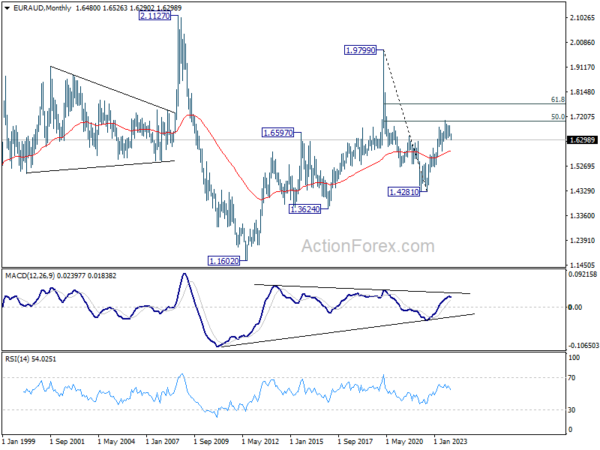

In the longer term picture, fall from 1.9799 (2020 high) is seen as a long term decline at the same scale as the rise from 1.1602 (2012 low). Rebound from 1.4281 is seen as the second leg. As long as 55 M EMA (now at 1.5846) holds, this second leg could still extend higher. However, sustained trading below 55 M EMA will open up the bearish case for extending the decline through 1.4281 low.