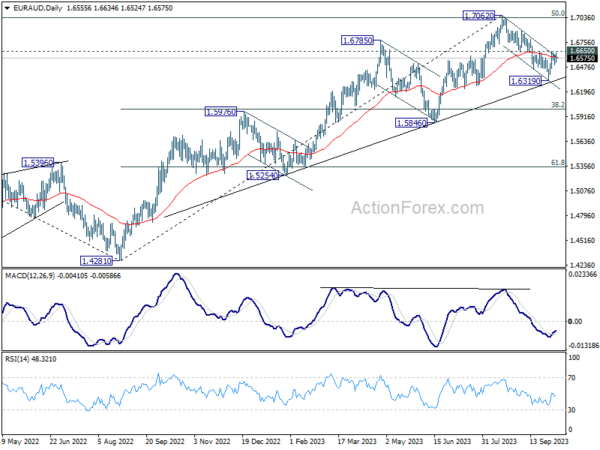

EUR/AUD rebounded strongly last week but failed to break through 1.6650 resistance. Initial bias remains neutral this week first, and another decline is in favor. on the downside, below 1.6446 minor support will bring retest of 1.6319. Break there will resume the decline from 1.7062 to 1.6000 fibonacci level. On the upside, firm break of 1.6650 resistance will argue that pull back from 1.7062 has completed, after drawing support from medium term rising trend line. Further rally would be seen back to retest 1.7062.

In the bigger picture, fall from 1.7062 is probably correcting whole up trend from 1.4281 (2022 low). Deeper decline would be seen to 38.2% retracement of 1.4281 to 1.7062 at 1.6000. Strong support could be seen there to bring rebound, at least on first attempt. This will remain the favored case as long as 1.6650 resistance holds.

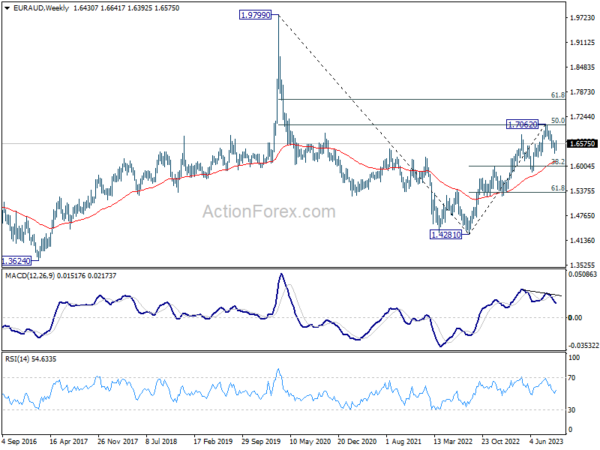

In the longer term picture, loss of upside momentum as seen in 55 W MACD at this stage argues that rise from 1.4281 (2022 low) is more likely a corrective move. Further rise could still be seen as long as 1.5846 support holds. But upside will likely be limited by 61.8% retracement of 1.9799 to 1.4281 at 1.7691. Firm break of 1.5846 support will argue that the rise has completed, and another medium term down leg has started.