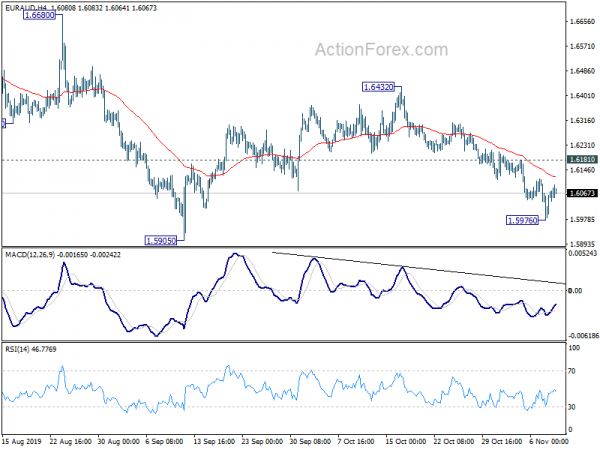

EUR/AUD’s decline from 1.6432 extended to as low as 1.5976 last week but formed a temporary low ahead of 1.5894/5905 key support zone. Initial bias is neutral this week first. Further fall is expected as long as 1.6181 resistance holds. On the downside, below 1.5976 will target 1.5894/5905. Decisive break there will carry larger bearish implications. On the upside, though, break of 1.6181 will turn bias back to the upside for 1.6432 resistance instead.

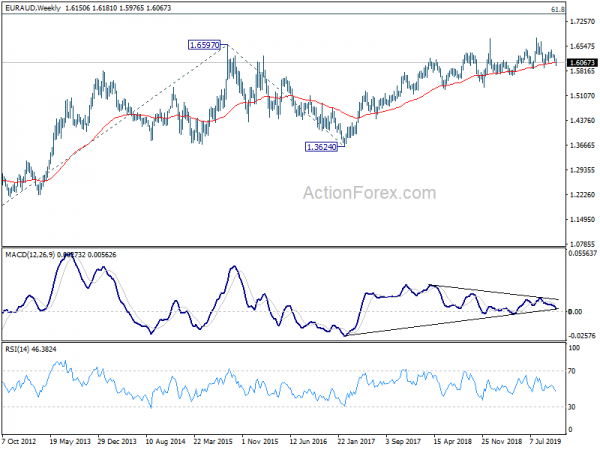

In the bigger picture, as long as 1.5894 support holds, outlook remains bullish. Firm break of 1.6786 will resume up trend from 1.1602 (2012 low). Next upside target is 61.8% retracement of 2.1127 (2008 high) to 1.1602 at 1.7488. However, sustained break of 1.5894 will have 55 week EMA (now at 1.6058) firmly taken out too. That should indicate medium term topping and target 1.5346 key support next.

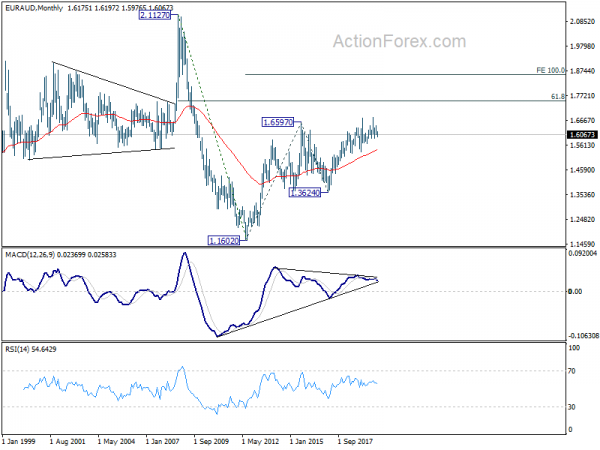

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) is still in progress for 61.8% retracement of 2.1127 to 1.1602 at 1.7488. This will remain the favored case as long as 1.5894 remains intact. However, firm break of 1.5894 will be an early sign of major topping and turn focus to 1.5346 key support for confirmation.