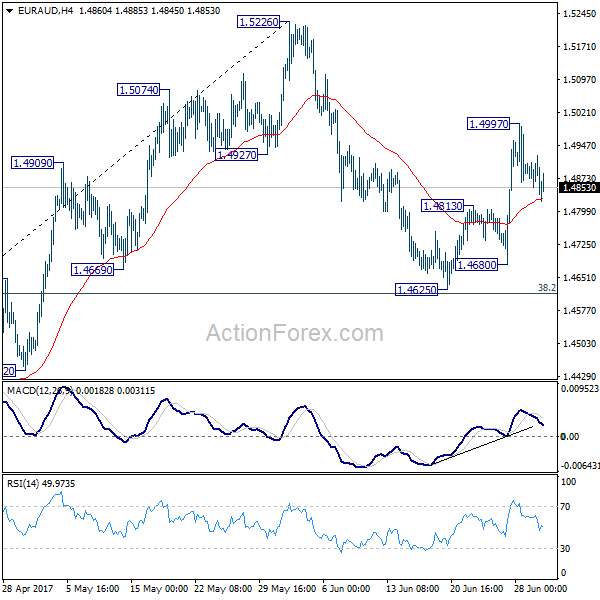

Daily Pivots: (S1) 1.4853; (P) 1.4890; (R1) 1.4925; More…

A temporary top is in place at 1.4997 and intraday bias is turned neutral. Break of 1.4813 will argue that rebound from 1.4625 has completed and will turn bias back to the downside for this support. On the upside, above 1.4997 will target a test on 1.5226 high next.

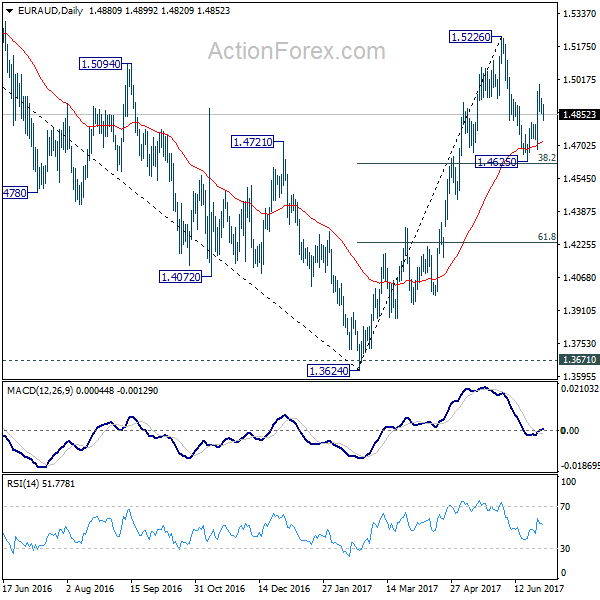

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction should be completed at 1.3624 after defending 1.3671 key support. Rise from 1.3642 would extend to 61.8% retracement of 1.6587 to 1.3624 at 1.5455. Sustained break there will pave the way to retest 1.6587. However, sustained break of 1.4669 support will dampen this bullish view. We’ll assess the outlook later after looking at the structure and depth of the pull back.