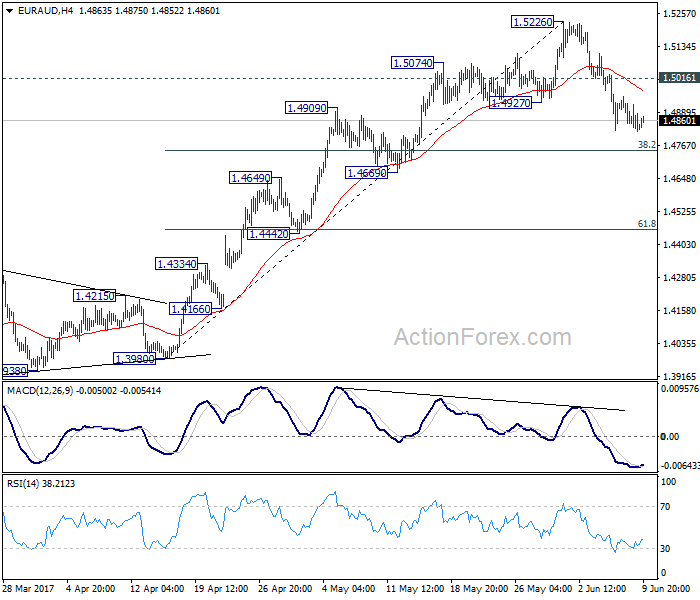

EUR/AUD’s break of 1.4927 support last week confirmed short term topping at 1.5226, on bearish divergence condition in 4 hour MACD. Deeper decline could be seen initial this week for 38.2% retracement of 1.3980 to 1.5226 at 1.4750 as the correction continues. At this point, we’d expect strong support from 1.4669 to contain downside and bring rebound. Above 1.5015 minor resistance will turn bias to the upside for 1.5226 first. Break will target next medium term fibonacci level at 1.5455.

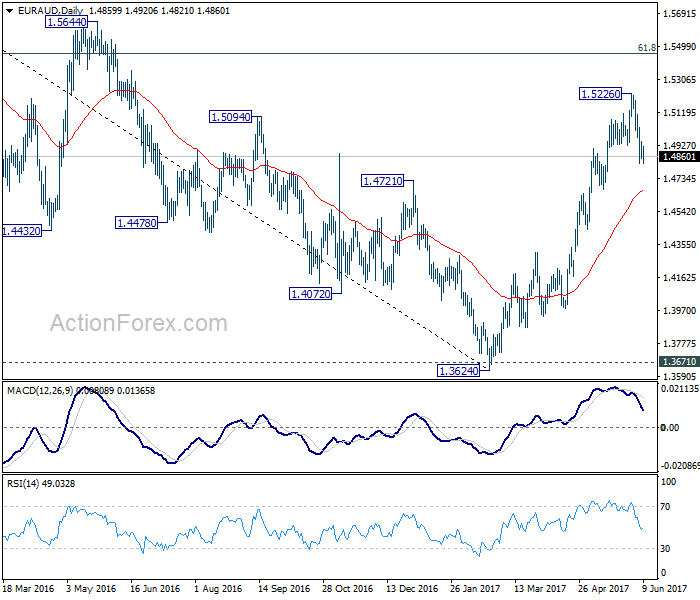

In the bigger picture, price actions from 1.6587 medium term top are viewed as a corrective pattern. Such correction should be completed at 1.3624 after defending 1.3671 key support. Rise from 1.3642 is now expected to target 61.8% retracement of 1.6587 to 1.3624 at 1.5455. Sustained break there will pave the way to retest 1.6587. In any case, outlook will now stay cautiously bullish as long as 1.4669 support holds. Break of 1.4669 will dampen the bullish view and would at least bring deeper fall back to 55 week EMA (now at 1.4539).

In the longer term picture, the rise from 1.1602 long term bottom isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3671 should confirm trend reversal and target 1.1602 long term bottom again.