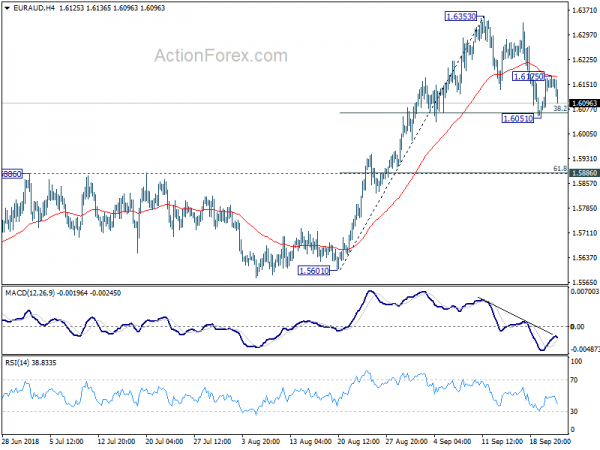

EUR/AUD’s correction from 1.6353 extended to as low as 1.6051 last week and drew support from 38.2% retracement of 1.5601 to 1.6353 at 1.6066. But recovery was limited by 4 hour 55 EMA. Initial bias is neutral this week first. On the downside, break of 1.6051 will extend the correction. But downside downside should be contained well above 1.5886 cluster support (61.8% retracement at 1.5888) to bring rise resumption. On the upside, above 1.6175 will suggest that the pull back is completed and turn bias to the upside for retesting 1.6353.

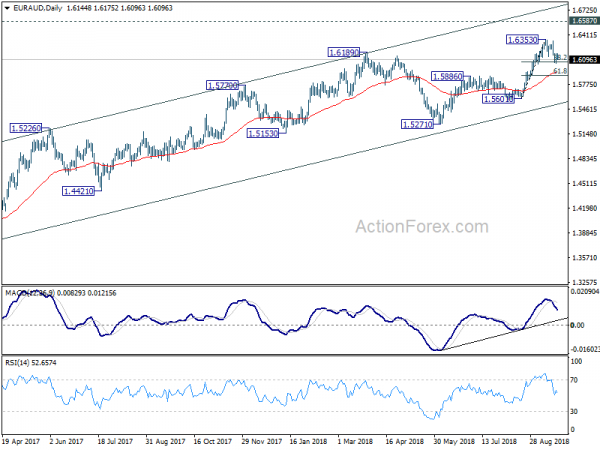

In the bigger picture, up trend from 1.3624 (2017 low) is still in progress. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5886 resistance turned support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back.

In the longer term picture, the rise from 1.1602 long term bottom (2012 low) isn’t over yet. We’ll keep monitoring the development but there is prospect of extending the rise to 61.8% retracement of 2.1127 to 1.1602 at 1.7488 and above. However, sustained trading below 1.3624 key support should indicate long term reversal and target 1.1602 long term bottom again.