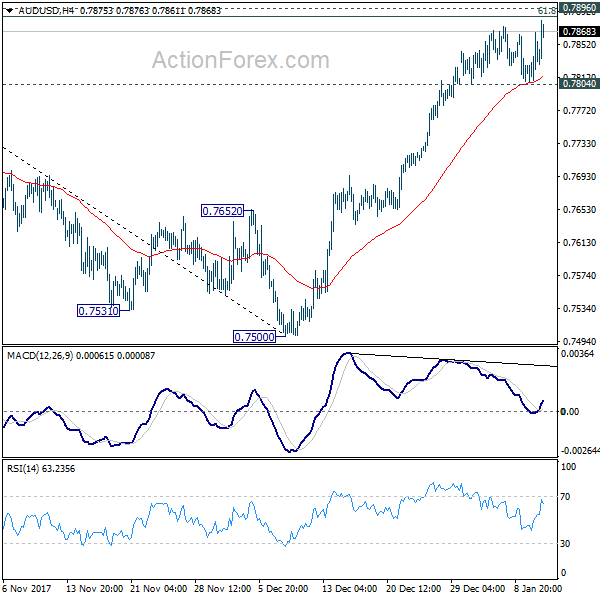

Daily Pivots: (S1) 0.7811; (P) 0.7838; (R1) 0.7869; More…

AUD/USD’s rally resumed after drawing support from 4 hour 55 EMA. Outlook is unchanged. Considering bearish divergence condition in 4 hour MACD, upside should be limited by 0.7896 cluster resistance (61.8% retracement of 0.8124 to 0.7500 at 0.7886) resistance zone to bring short term topping. Break of 0.7804 minor support will turn bias to the downside for 55 day EMA (now at 0.7725). However, sustained break of 0.7886/96 will pave the way for retesting 0.8124 high.

In the bigger picture, we’re still slightly favoring the case that corrective rise from 0.6826 medium term bottom is completed at 0.8124, after hitting 55 month EMA (now at 0.8032). But stronger than expected rebound from 0.7500 is dampening this bearish view. On the downside, break of 0.7500 will target 0.7328 key cluster support (61.8% retracement 0.6826 to 0.8124 at 0.7322) to confirm this bearish case. But break of 0.8124 will extend the rise from 0.6826 to 38.2% retracement of 1.1079 (2011 high) to 0.6826 (2016 low) at 0.8451 before completion.