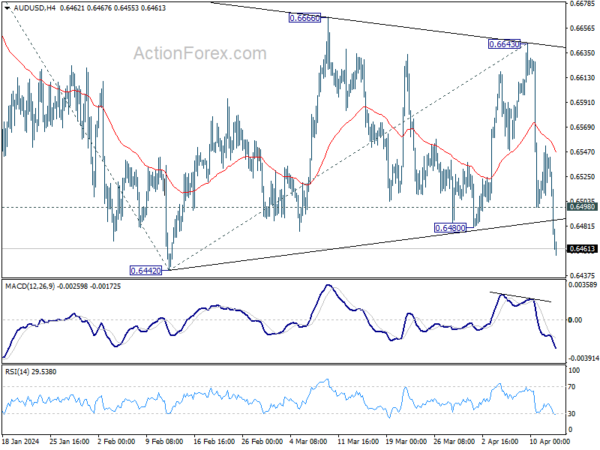

AUD/USD’s steep decline last week suggests that consolidation from 0.6442 has completed at 0.6643 already. Initial bias stays on the downside this week. Firm break of 1.6442 will confirm resumption of the fall from 0.6870 and target 61.8% projection of 0.6870 to 0.6442 from 0.6643 at 0.6378. On the upside, above 0.6498 resistance will turn intraday bias and bring consolidations. But risk will stay mildly on the downside as long as 0.6643 resistance holds, in case of recovery.

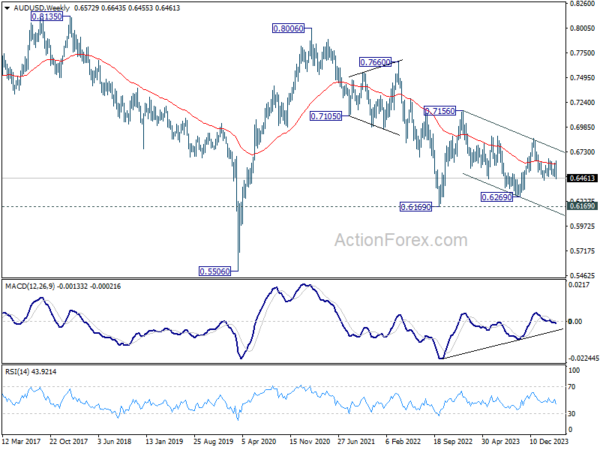

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Fall from 0.7156 (2023 high) is seen as the second leg, which is still be in progress. Overall, sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

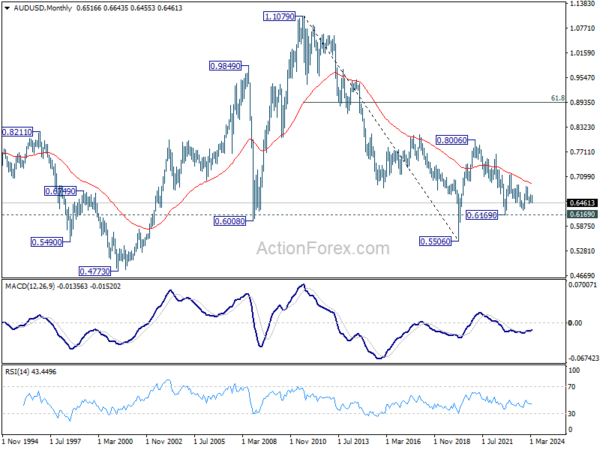

In the long term picture, the down trend from 1.1079 (2011 high) should have completed at 0.5506 (2020 low) already. It’s unsure yet whether price actions from 0.5506 are developing into a corrective pattern, or trend reversal. But in either case, fall from 0.8006 is seen the second leg of the pattern. Hence, in case of deeper decline, strong support should emerge above 0.5506 to bring reversal.