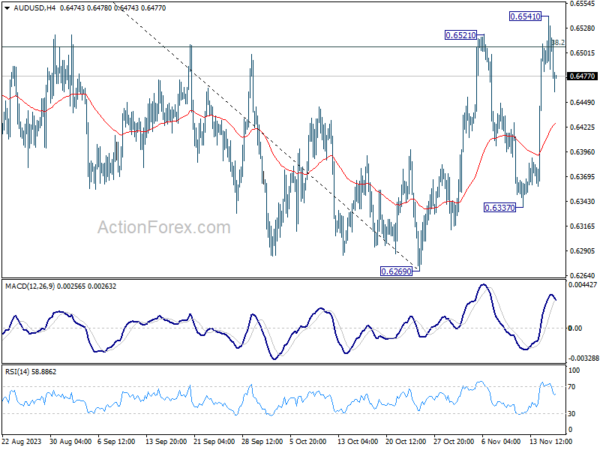

Daily Pivots: (S1) 0.6481; (P) 0.6512; (R1) 0.6540; More…

Despite spiking higher to 0.6541, subsequent retreat in AUD/USD suggests that a temporary top was formed. Intraday bias is turned neutral for some consolidations first. Downside should be contained by 55 4H EMA (now at 0.6427) to bring rebound. Break of 0.6541, and sustained trading above 38.2% retracement of 0.6894 to 0.6269 at 0.6508, will argue that whole corrective fall from 0.7156 has completed with three waves down to 0.6269. Stronger rally should seen to falling channel resistance (now at 0.6684) next.

In the bigger picture, there is no confirmation that down trend from 0.8006 (2021 high) has completed. While current rebound from 0.6269 might extend higher, it could be the third leg of the corrective pattern from 0.6169 (2022 low) only. For now, medium term bearishness will remain as long as 0.6894 resistance holds.