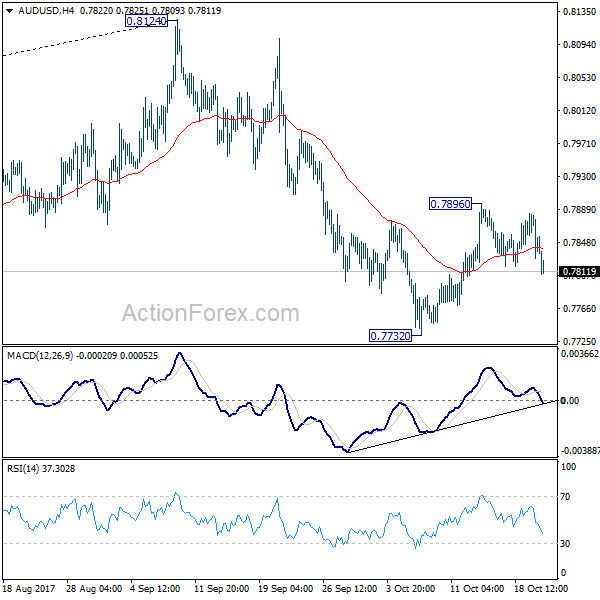

AUD/USD’s rebound from 0.7732 was limited at 0.7896 and turned sideway. Initial bias remains neutral this week first. On the downside, break of 0.7732 will resume the decline from 0.8124 and target medium term fibonacci level at 0.7628 first. This will also affirm the case of medium term reversal. On the upside, however, break of 0.7896 will extend the rebound to 61.8% retracement of 0.8124 to 0.7732 at 0.7974 and possibly above.

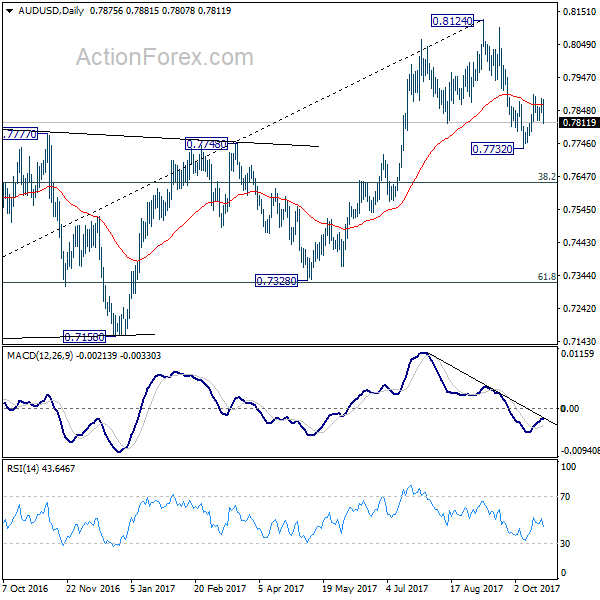

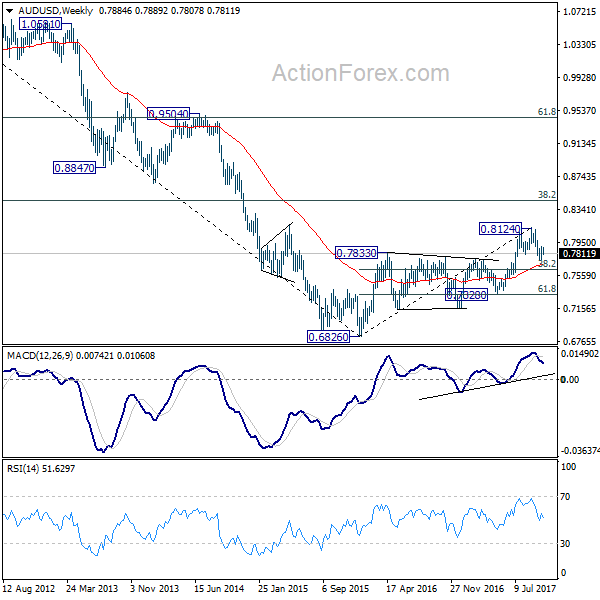

In the bigger picture, rise from 0.6826 medium term bottom is seen as corrective pattern. Current development suggests that it might be completed with three waves up to 0.8124 already. Break of 38.2% retracement of 0.6826 to 0.8124 at 0.7628 will firm this bearish case. And, decisive break of 0.7328 key cluster support (61.8% retracement at 0.7322) will confirm and bring retest of 0.6826 low. In case rise from 0.6826 resumes and extends, strong resistance should be seen at 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside.

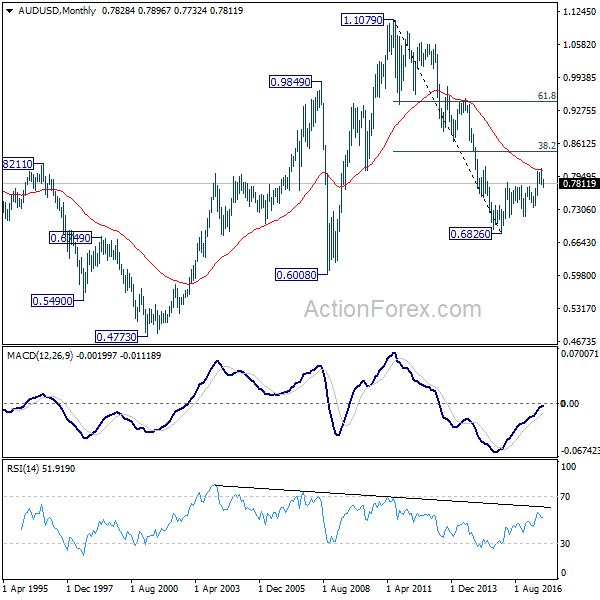

In the longer term picture, 0.6826 is seen as a long term bottom. Rise from there could either reverse the down trend from 1.1079, or just develop into a corrective pattern. At this point, we’re favoring the latter. And, as long as 38.2% retracement of 1.1079 to 0.6826 at 0.8451 holds, we’d anticipate another decline through 0.6826 at a later stage.