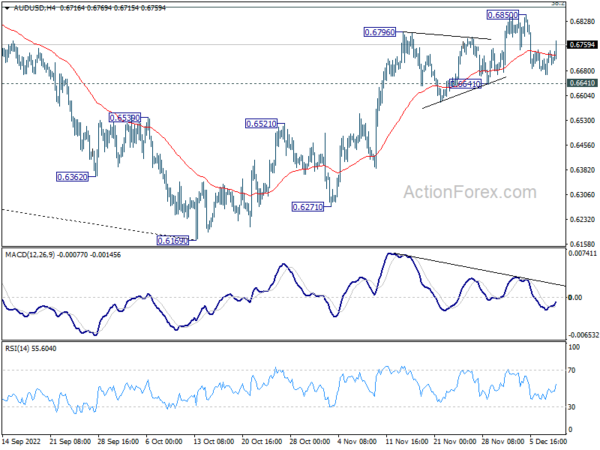

Daily Pivots: (S1) 0.6682; (P) 0.6712; (R1) 0.6755; More…

AUD/USD recovers ahead of 0.6641 resistance but stays below 0.6850 resistance. Intraday bias remains neutral first. Again, considering bearish divergence condition in 4 hour MACD, break of 0.6641 support should indicate short term topping, following rejection by 0.6871 fibonacci level. Intraday bias will be back on the downside for 0.6521 resistance turned support first. However, sustained break of 0.6871 will extend the rise from 0.6169 towards 55 week EMA at 0.6922.

In the bigger picture, a medium term bottom is in place at 0.6160 already. But it’s too early to call for trend reversal. Nevertheless, even as a corrective move, rise from 0.6169 should target 38.2% retracement of 0.8006 to 0.6169 at 0.6871. Sustained trading above 55 week EMA (now at 0.6922) will raise the chance of the start of a bullish up trend. However, rejection by 0.6781 or 55 week EMA, followed by 0.6521 resistance turned support and retain medium term bearishness.