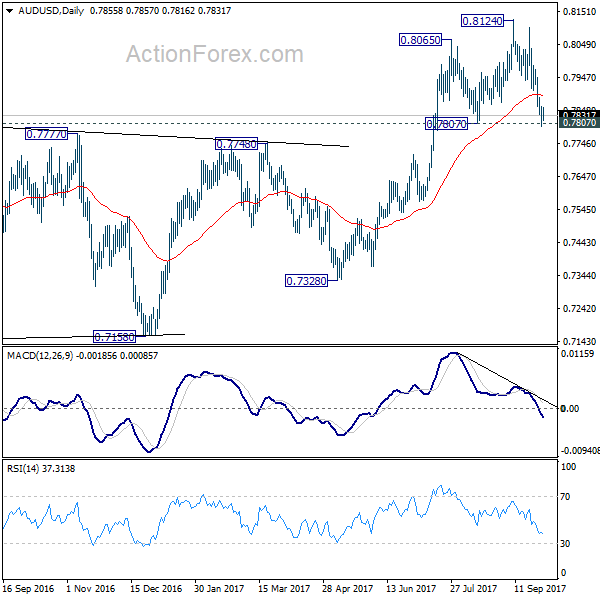

AUD/USD’s fall from 0.8124 extended lower last week and breached 0.7807 support. But it cannot sustain below this level yet. Initial bias stays neutral this week first, with focus on 0.7807. Considering bearish divergence condition in daily MACD, firm break of 0.7807 will indicate near term reversal. Outlook will then be turned bearish for 55 week EMA (now at 0.7669) first. Meanwhile, rebound from 0.7807 will retain bullishness. Above 0.7907 minor resistance will turn bias back to the upside for retesting 0.8124 high.

In the bigger picture, rise from 0.6826 medium term bottom is seen as corrective pattern. In case of further rally, strong resistance should be seen at 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside. Meanwhile, firm break of 0.7807 is the first signal that such correction is focused. Break of 0.7328 will bring retest of 0.6826 low.

In the longer term picture, 0.6826 is seen as a long term bottom. Rise from there could either reverse the down trend from 1.1079, or just develop into a corrective pattern. At this point, we’re favoring the latter. And, as long as 38.2% retracement of 1.1079 to 0.6826 at 0.8451 holds, we’d anticipate another decline through 0.6826 at a later stage.