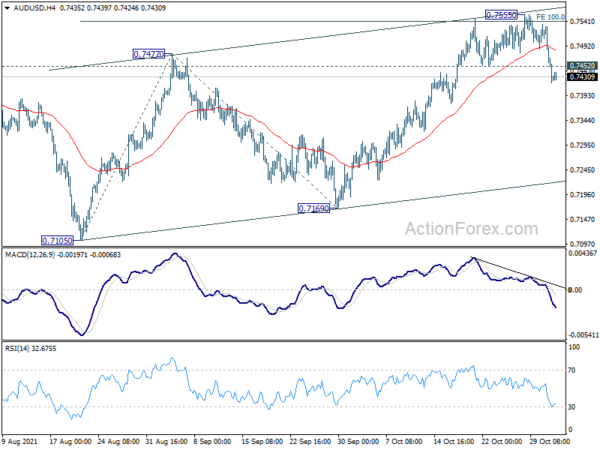

Daily Pivots: (S1) 0.7389; (P) 0.7460; (R1) 0.7500; More…

Break of 0.7452 support suggests that short term topping at 0.7555. Intraday bias in AUD/USD is turned back to the downside for 55 day EMA (now at 0.7393). Sustained break there will argue that rebound from 0.7105 is complete with three waves up to 0.7555. That would also argue that fall from 0.8006 is ready to resume through 0.7105 low. On the upside, break of 0.7555 will turn bias back to the upside and resume the rebound instead.

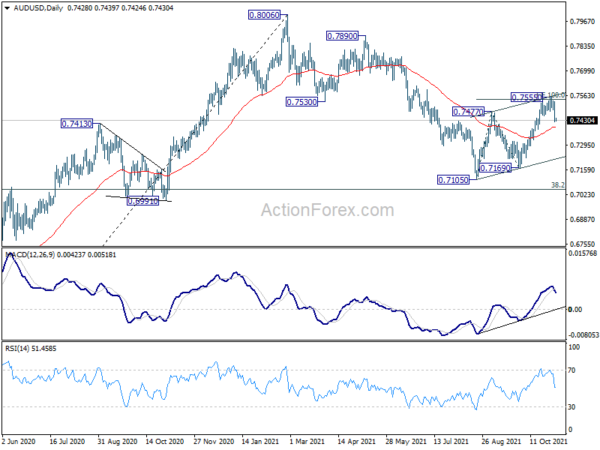

In the bigger picture, with 0.6991 cluster support (38.2% retracement of 0.5506 to 0.8006 at 0.7051) intact, we’re seeing price action from 0.8006 as a correction only. That is, up trend from 0.5506 low would resume after the correction completes. In that case, main focus will be 0.8135 key resistance (2018 high). Sustained break there will carry larger bullish implications. However, sustained break of 0.6991 will argue that the whole medium term trend has indeed reversed.