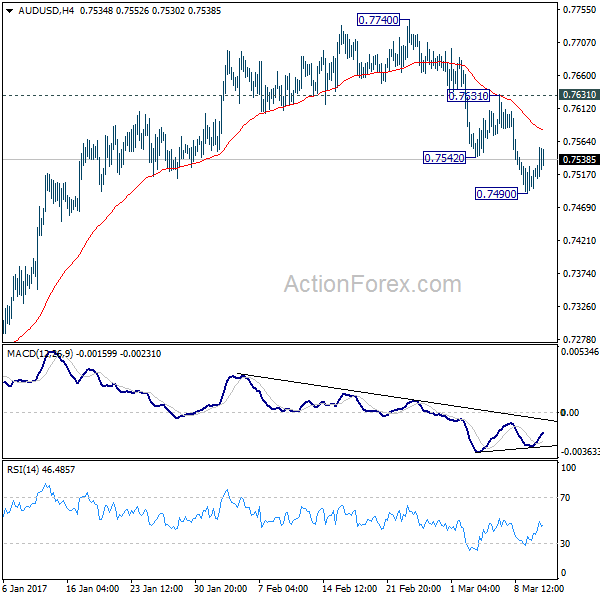

AUD/USD dropped to as low as 0.7490 last week but formed a temporary low there and recovered. The close below 55 day EMA is consistent with our preferred case that whole rise from 0.7150 has completed at 0.7740. While some consolidations could be seen initially this week, deeper decline is expected ahead to target 0.7158 support level.

Initial bias is neutral this week for consolidations. Upside of recovery should be limited by 0.7531 resistance and bring another decline. Below 0.7490 will extend the fall from 0.7740 to target 0.7144/7158 support zone. However, break of 0.7631 resistance will dampen our bearish view and turn bias back to the upside for 0.7740 instead.

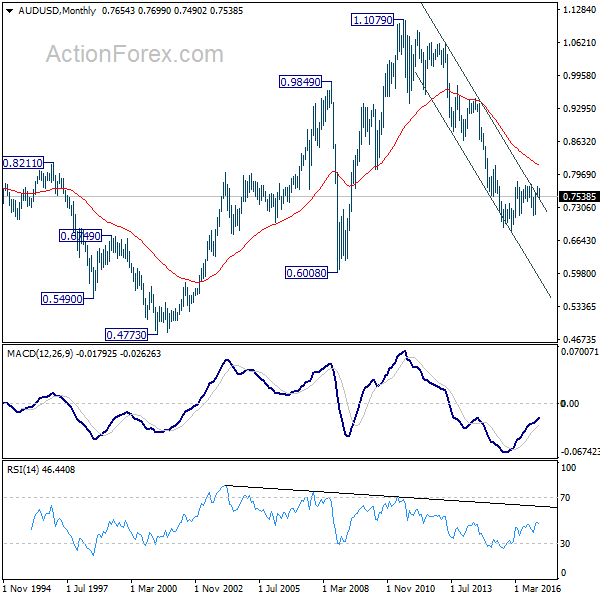

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seek to 55 month EMA (now at 0.8185) and above.

In the longer term picture, while the down trend from 1.1079 might extend lower, we’re not anticipating a break of 0.6008 (2008 low) yet. We’ll look for bottoming above there to reverse the medium term trend.