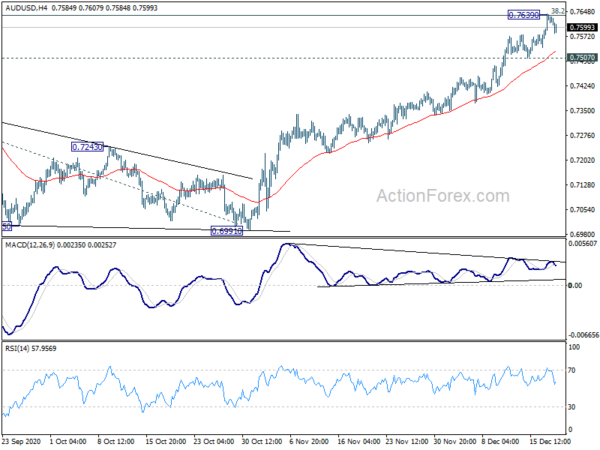

Daily Pivots: (S1) 0.7583; (P) 0.7612; (R1) 0.7656; More…

Intraday bias in AUD/USD is turned neutral first as it retreats after hitting 0.7635 key long term fibonacci level. On the upside, decisive break of 0.7635 will carry larger bullish implications. Next target will be 61.8% projection of 0.5506 to 0.7413 from 0.6991 at 0.8170. Nevertheless, break of 0.7507 support will indicate short term topping, on bearish divergence condition in 4 hour MACD. Intraday bias will be turned back to the downside for deeper pull back.

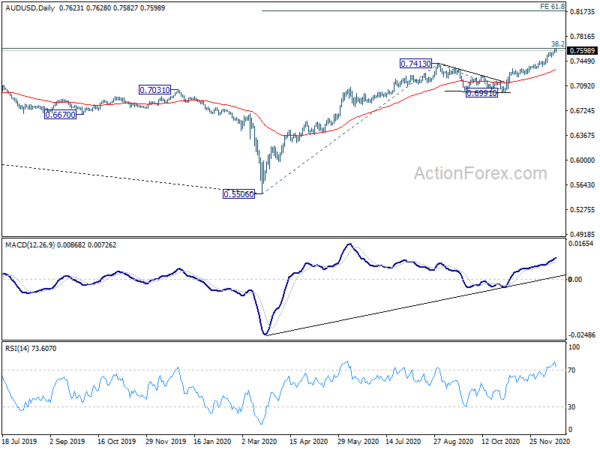

In the bigger picture, the sustained trading above 55 week EMA (now at 0.6994) is a sign of medium term bullishness. Nevertheless, AUD/USD will still need to overcome 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635 decisively to indicate completion of long term down trend from 1.1079. In that case, next medium term target would be 61.8% retracement at 0.8950. Rejection by 0.7635 will retain long term bearishness instead.