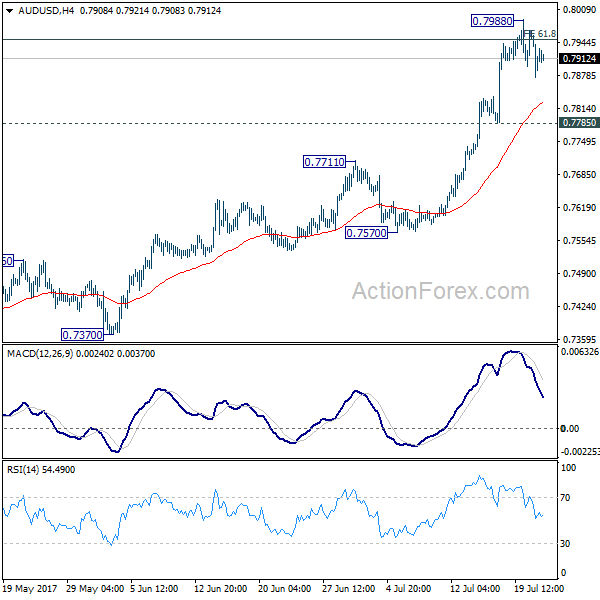

AUD/USD’s rally continued last week and reached as high as 0.7988, meeting 61.8% projection of 0.6826 to 0.7833 from 0.7328 at 0.7950. A temporary top is formed there. Initial bias is neutral this week for consolidation first. Near term outlook will remain bullish as long as 0.7785 support holds and another rise is expected. Break of 0.7988 will target 100% projection at 0.8335 next. However, break of 0.7785 will argue that deeper pull back in under way and could target 55 day EMA (now at 0.7628).

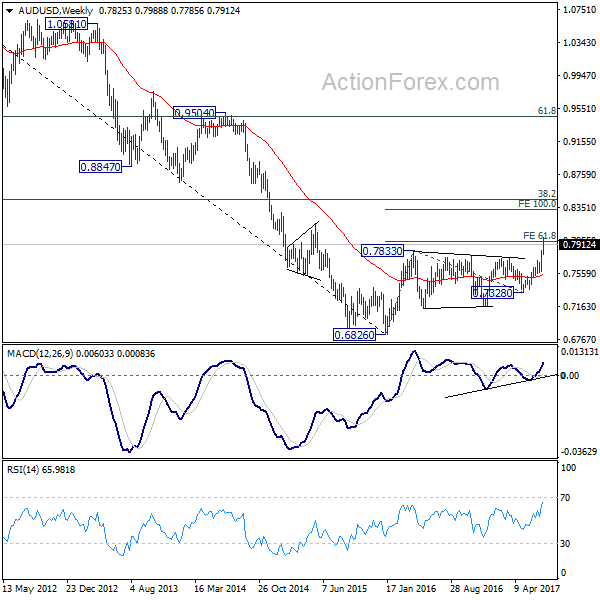

In the bigger picture, current development suggests that rebound from 0.6826 is developing into a medium term rise. There is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, further rise is now expected to 55 month EMA (now at 0.8100) or even further to 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7328 support is needed to confirm completion of the rebound. Otherwise, further rise is now expected.

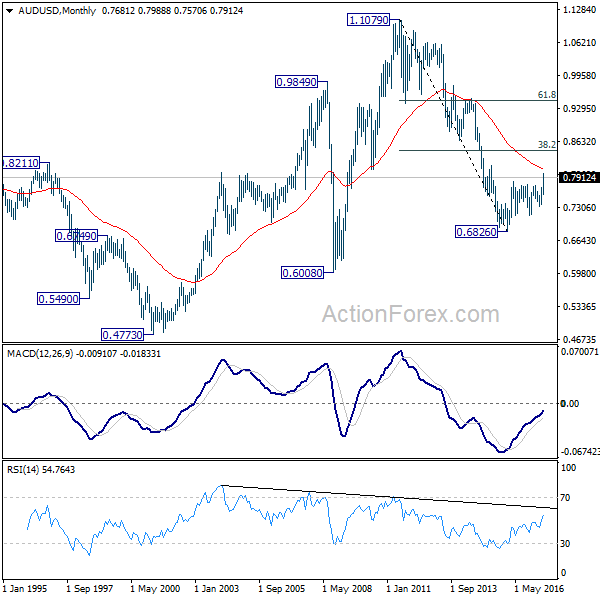

In the longer term picture, 0.6826 is seen as a long term bottom. Rise from there could either reverse the down trend from 1.1079, or just develop into a corrective pattern. At this point, we’re favoring the latter. And, as long as 38.2% retracement of 1.1079 to 0.6826 at 0.8451 holds, we’d anticipate another decline through 0.6826 at a later stage.