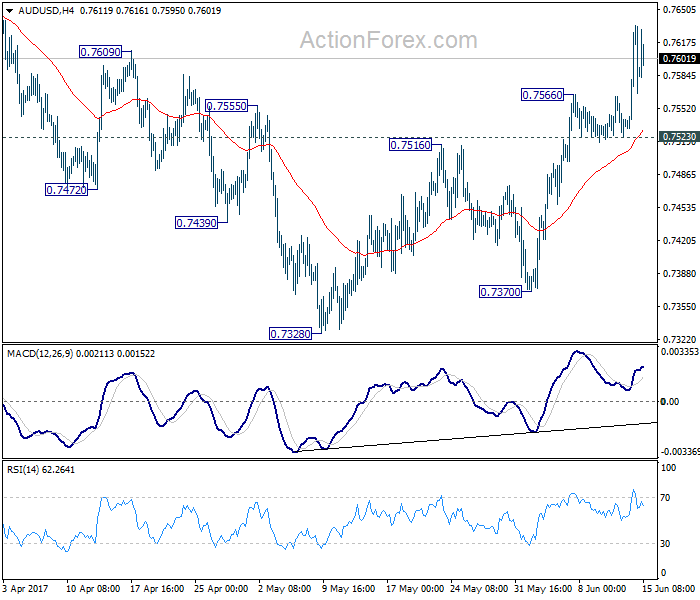

Daily Pivots: (S1) 0.7536; (P) 0.7585; (R1) 0.7639; More….

AUD/USD’s rise from 0.7328 resumed by taking out 0.7566 and reaches as high as 0.7635 so far. Intraday bias is back on the upside for 0.7748 resistance and above. There is no clear sign of range breakout yet. So, we’ll be cautious on topping again as it approaches medium term fibonacci level at 0.7849. For now, near term outlook will stay mildly bullish as long as 0.7523 support holds.

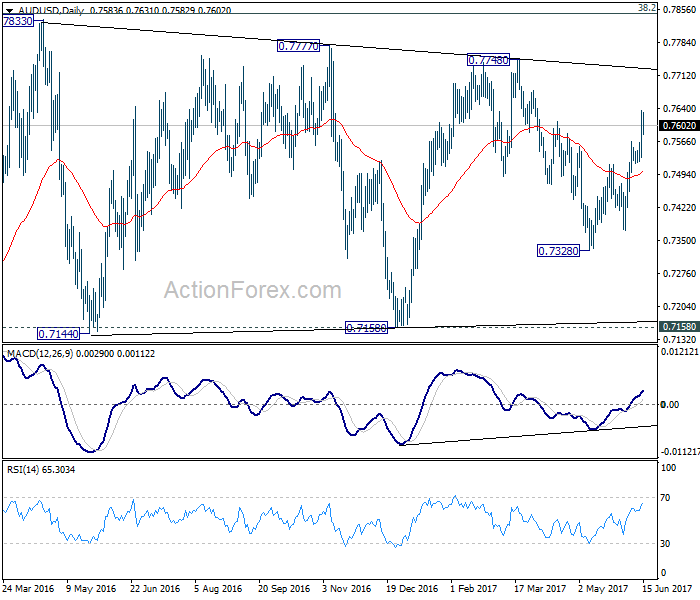

In the bigger picture, we’re still treating price actions from 0.6826 low as a corrective pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8091) and above.