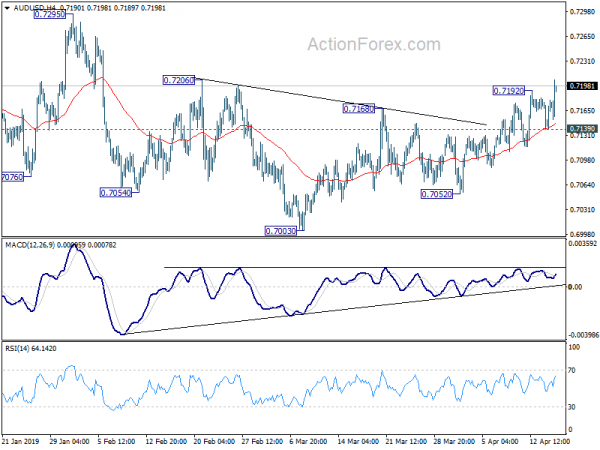

Daily Pivots: (S1) 0.7149; (P) 0.7165; (R1) 0.7190; More…

AUD/USD’s choppy rise from 0.7003 resumed by taking out 0.7192 and reaches as high as 0.7205 so far. Intraday bias is back on the upside for 0.7295 resistance. Upside momentum is relatively weak and structure of the recovery is corrective looking. Thus, upside could be limited by 0.7295 to bring near term reversal. On the downside, break of 0.7139 minor support will turn intraday bias back to the downside for 0.7003/7052 support zone instead.

In the bigger picture, break of medium term channel resistance is the first sign of bullish reversal. But there is no confirmation yet. As long as 0.7393 resistance holds, larger fall from 0.8135 is still expected to resume later. Such decline is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.