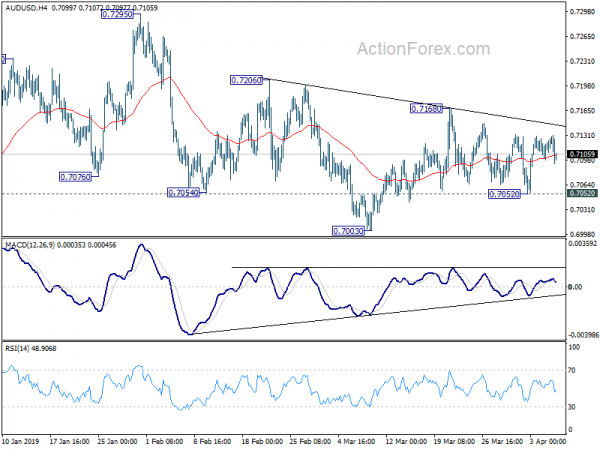

Despite some volatility, AUD/USD was bounded in range below 0.7168 last week and near term outlook remains unchanged. Initial bias remains neutral this week first. On the upside, firm break of 0.7168 resistance will suggest that the corrective decline from 0.7295 has completed at 0.7003 already. Intraday bias will be turned to the upside to resume the rebound from 0.6722 through 0.7295. On the downside, though, sustained break of 0.7052 will target 0.7004 first. Break will resume the fall from 0.7295 instead.

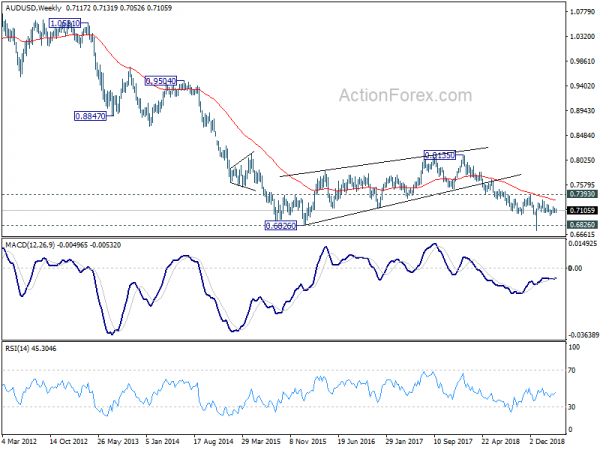

In the bigger picture, as long as 0.7393 resistance holds, fall from 0.8135 is still expected to extend. Such decline is seen as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 (2016 low) will confirm this bearish view and resume the down trend to 0.6008 (2008 low). However, firm break of 0.7393 will argue that fall from 0.8135 has completed. And corrective pattern from 0.6826 has started the third leg, targeting 0.8135 again.

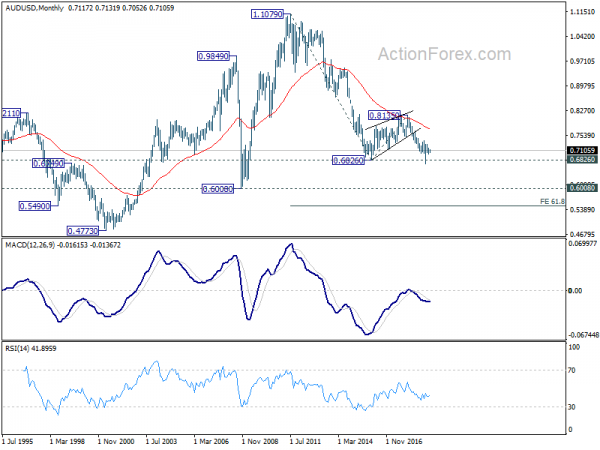

In the longer term picture, prior rejection by 55 month EMA maintained long term bearishness in AUD/USD. That is, down trend from 1.1079 (2011 high) is still in progress. Sustained break of 0.6826 will target 0.6008 low and then 61.8% projection of 1.1079 to 0.6826 from 0.8135 at 0.5507.