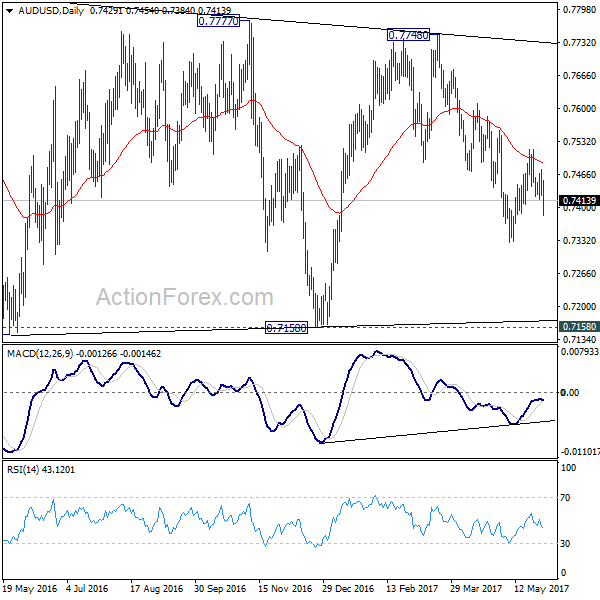

Daily Pivots: (S1) 0.7411; (P) 0.7443; (R1) 0.7462; More…

The break of 0.7405 minor support confirmed that corrective rise from 0.7328 has completed at 0.7516. Intraday bias is turned back to the downside for 0.7328 first. Break will extend the decline from 0.7748 to 0.7144/7158 support zone. However, break of 0.7516 resistance will now indicate near term reversal and turn bias back to the upside.

In the bigger picture, we’re still treating price actions from 0.6826 low as a corrective pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8115) and above.