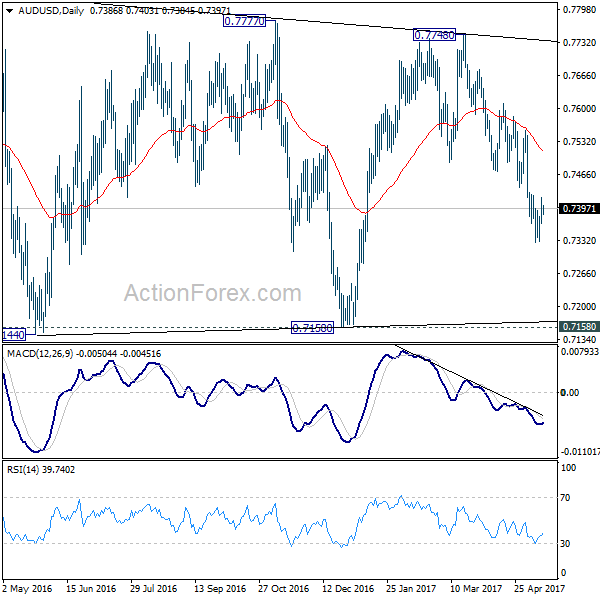

Daily Pivots: (S1) 0.7359; (P) 0.7390; (R1) 0.7416; More…

Intraday bias in AUD/USD remains neutral as the consolidation from 0.7382 continues. Upside of recovery should be limited below 0.7555 resistance to bring another fall. Below 0.7382 will target 0.7144/7158 support zone. However, there is no clear sign of larger down trend resumption yet. Hence we’ll be cautious on strong support from 0.7144/58 to contain downside and bring rebound. On the upside, firm break of 0.7555 will argue that fall from 0.7748 is completed and turn bias back to the upside.

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8115) and above.