UK PMI manufacturing rose 0.1 to 55.1 in March, above expectation of 54.7. Markit noted that it signals “steady growth rate at the end of opening quarter”.

Rob Dobson, Director at IHS Markit, which compiles the survey:

- “The latest PMI survey provided further evidence that UK manufacturing has entered a softer growth phase so far this year. Although the pace of output expansion ticked higher in March, which is especially encouraging given the heavy snowfall during the month, this was offset by slower increases in new orders and employment. Average rates of increase over the opening quarter as a whole are also down noticeably from the growth spurt seen at the end of 2017. Compared to official data, the performance through quarter one is consistent with only a 0.4-0.5% gain in production volumes, a considerable slide from the fourth quarter’s 1.3% increase.

- “The key question is whether growth can now be sustained, albeit at a lower level, into the coming months. On that front the news is generally positive. Manufacturers are still reporting solid inflows of new work from domestic and overseas markets. Business optimism is holding steady at an elevated level, with over 54% of companies expecting output to expand over the coming 12 months. With cost inflationary pressures also moderating to provide some respite for margins, the sector looks set to make further slow and steady progress as we head through the spring.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:

- “After the mini-boom of productivity at the end of last year, the sector still held its own, delivering a steady if unremarkable performance with overall activity improving very modestly from last month.

- “Purchasing activity was higher than February’s 8- month growth low but purchasers were frustrated by their suppliers who failed to deliver essential materials on time and delivery times continued to get longer. As shortages were reported the finger of suspicion was pointed at the continuing impact of inflation on raw material prices caused by the scarcity, and subsequently forcing firms to pass on these increased prices to customers at a significantly elevated rate.

- “However, the biggest disappointment was the softening of new orders to a nine-month low followed by a feeble rise in job creation as the most discouraging result this year. While trade from the domestic market was still strong, and export markets also grew for the 23rd month in a row, the foundations for the sector’s continuing strength were looking a little more unstable.

- “Without a significant rise in new orders, and if supply chains are still disrupted by shortages or the weather, for the next few months it’s anticipated that there will be a continued muted pace of growth. A rather apathetic prediction, but while optimism remains high and the sector continues its efforts to increase marketing activity and launch new products, everything could change.”

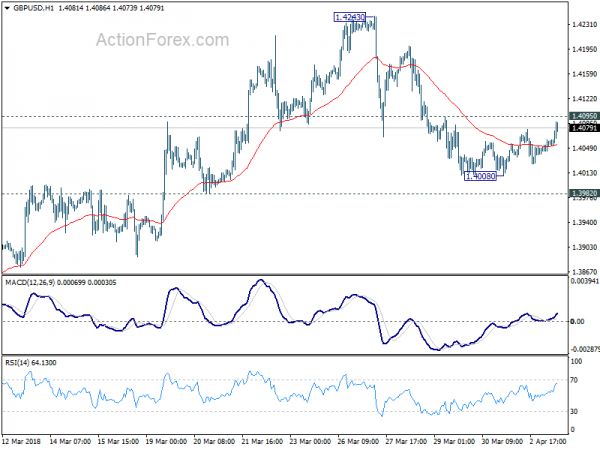

GBP trades notably higher today against USD and JPY. With 1.3982 minor support intact, choppy fall from 1.4243 is seen as a corrective pull back. Break of 1.4095 will suggests that such pull back is completed and bring stronger rebound back to 1.4243.