US equities tumbled sharply on Monday, kicking off March with the biggest single-day decline in months, and the markets were rattled by the formal commencement of a US-led trade war.

The selloff started in the afternoon after US President Donald Trump reaffirmed that 25% tariffs on imports from Mexico and Canada would go into effect as scheduled on Tuesday. Hopes for a last-minute deal to avert the full imposition of tariffs were dashed. The Federal Register confirmed that the new duties would be officially imposed at 05:01 GMT.

Similarly, the additional 10% duty on Chinese goods was also slated to take effect at the same time, effectively raising the total tariff on thousands of Chinese products to 20%.

In quick response, Canada announced retaliatory measures, with Prime Minister Justin Trudeau confirming that CAD 155B worth of US goods would be hit with 25% tariffs if Trump’s levies proceed as planned. China’s commerce ministry also vowed countermeasures, calling the US tariffs “unreasonable and groundless, harmful to others.”

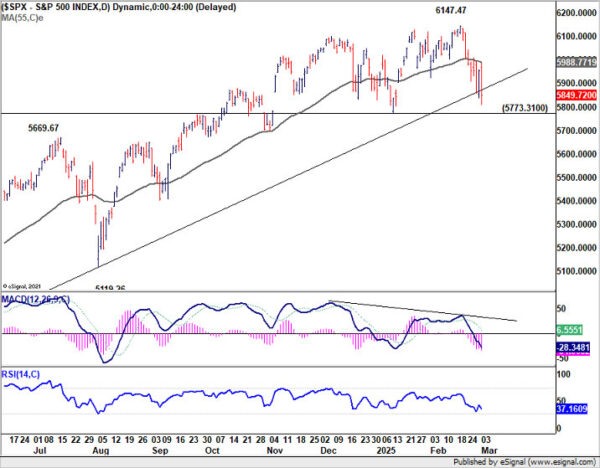

Technically, S&P 500’s rejection by 55 D EMA (now at 5988.77) is a near term bearish sign. Immediate focus is on 5773.31 support this week. Considering bearish divergence condition in D MACD, firm break of 5773.31 should confirm medium term topping that 6147.47. That would set up deeper correction to 55 W EMA (now at 5594.28) at least.