BoE is widely expected to lower interest rates by 25bps to 4.50% today, marking its third cut in the current cycle. The central bank is likely to maintain a cautious stance, reinforcing its guidance of a “gradual” approach, which suggests a pace of four quarter-point cuts throughout 2025.

The Monetary Policy Committee’s vote split will be a key focus, as divisions among policymakers could influence BoE’s forward guidance. Known hawk Catherine Mann may dissent and argue for keeping rates steady, while dovish member Swati Dhingra could push for a more aggressive 50bps cut. A wider split would highlight internal uncertainty over the pace of easing.

Alongside the rate decision, BoE will release its updated quarterly Monetary Policy Report, which is expected to reflect downward revisions to growth projections for 2025-2027. However, inflation forecasts, at least for 2025, could be revised higher. Such a combination would reinforce concerns over stagflation, a scenario where sluggish growth coincides with persistent inflationary pressures.

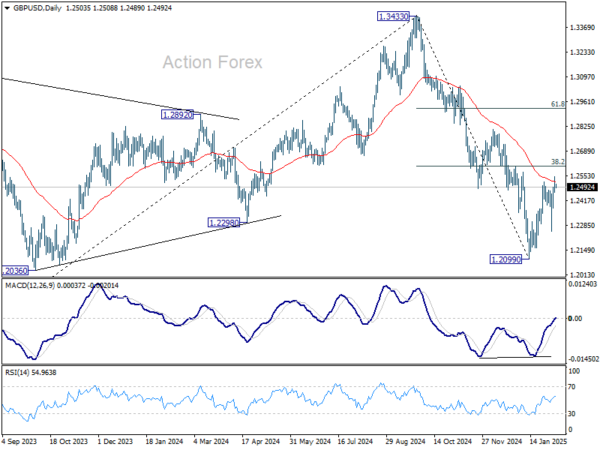

GBP/USD is hovering near a critical technical resistance zone ahead of BoE decision. The zone include 55 D EMA (now at 1.2522) and 38.2% retracement of 1.3433 to 1.2099 at 1.2609. Firm rejection from this zone would reinforce the view that recent price action from 1.2099 remains corrective, keeping the broader bearish trend intact. In this case, decline from 1.3433 should resume through 1.2099 low at a later stage.