AUD/NZD plunged in the Asian session, driven by contrasting developments in Australia and New Zealand. However, it is too early to declare a bearish trend reversal for the cross, with near-term sideways consolidation likely.

In Australia, RBA received some relief as headline inflation in October did not reaccelerate as feared. While the trimmed mean CPI showed underlying inflation pressures remain strong, declines in CPI excluding volatile items and holiday travel offered some hope. The data keeps the possibility of a February rate cut alive, albeit with low odds.

Meanwhile, in New Zealand, RBNZ’s 50bps rate cut aligned with expectations, but its projected easing path disappointed dovish expectations. RBNZ now forecasts the OCR to drop to 3.50% by the end of 2025, implying only 75bps of further cuts from the current 4.25%. This signals that RBNZ could slow its pace of rate cuts to 25bps steps as early as February, provided the economy stabilizes.

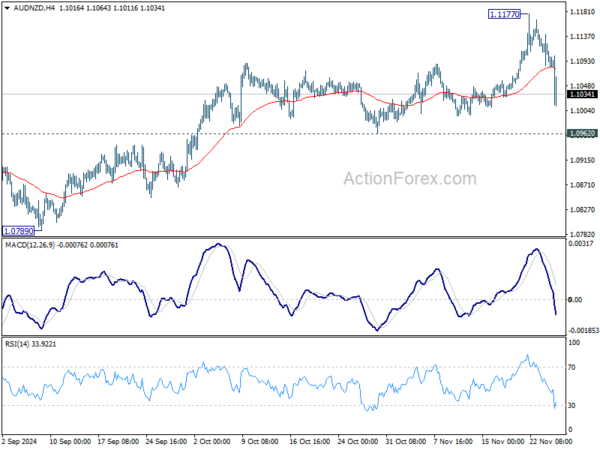

Technically, a short term top should be in place at 1.1177 in AUD/NZD with today’s steep fall. However, outlook will remain mildly bullish as long as 1.0962 support holds. Some consolidations is now expected between 1.0962/1.1177 before resuming the choppy rally from 1.0567.