Gold prices edged higher in Asian session today, extending their recent record-breaking run. While some market observers attribute the precious metal’s rally to uncertainty surrounding the upcoming US presidential election—with no clear frontrunner between Democrat Kamala Harris and Republican Donald Trump—the persistent climb in U.S. stock markets to new record highs suggests that domestic political factors may not be the primary driver. Instead, escalating geopolitical risks appear to be fueling increased demand for Gold as a safe-haven asset.

In the Middle East, Israel has intensified its military operations in both Gaza and Lebanon following recent developments, including the death of a prominent Hamas leader. Reports indicate that Iran-backed Hezbollah has conducted drone attacks targeting areas near Israeli Prime Minister Benjamin Netanyahu’s residence. The prospects for a near-term ceasefire seem increasingly remote, raising concerns about broader regional instability.

Even more concerning,, tensions are escalating in Eastern Europe. Thousands of North Korean troops are reportedly preparing to support Russia in its ongoing conflict in Ukraine, with some North Korean military officers already deployed. Ukrainian President Zelenskyy warned this could be the “first step to world war,” raising global alarm.

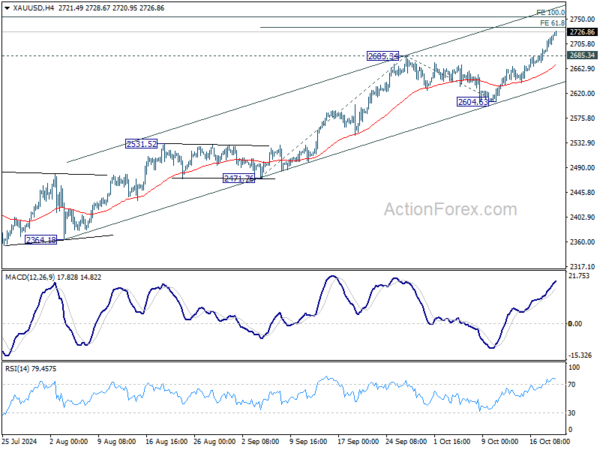

Technically, further rally is expected in Gold as long as 2685.34. Next target is 61.8% projection of 2471.76 to 2685.34 from 2604.53 at 2736.62.

But the a bigger test lies in 100% projection of 1984.05 to 2449.82 from 2239.45 at 2759.23. Strong resistance could be seen there to limit upside initially. However, decisive break above there would prompt upside acceleration. Next medium term target would then be 161.8% projection at 3047.08, which is slightly above 3000 psychological level.