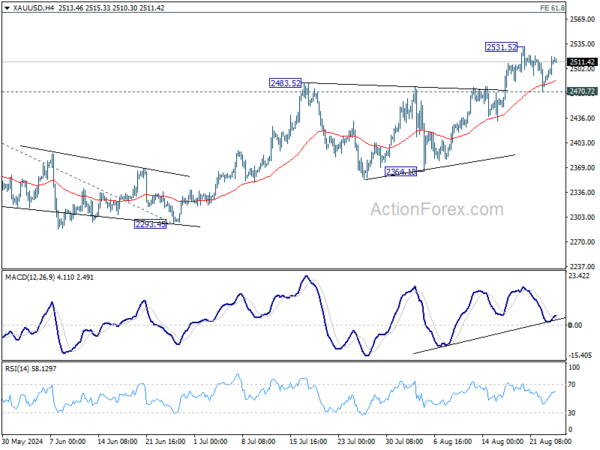

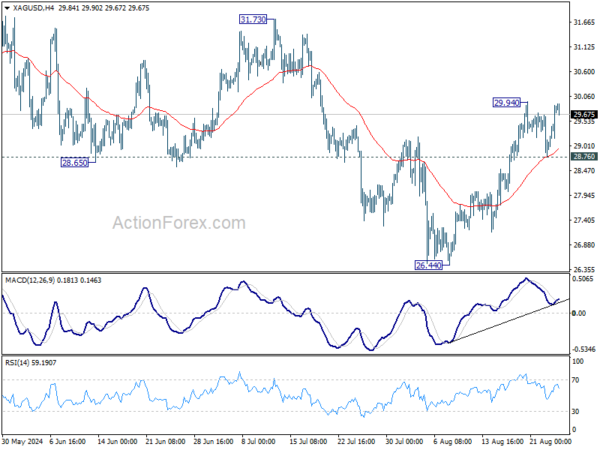

Both Gold and Silver are currently still caught in near-term consolidations despite the rally late last week. Both metals have the potential to extend their recent gains, but a more pronounced decline in Dollar may be necessary to provide the needed momentum.

As for Gold, further rally is expected as long as 2470.72 support holds. Firm break of 2531.57 will resume the long term up trend and extend the record run. Next target is 61.8% projection of 1984.05 to 2449.83 from 2293.45 at 2581.30. However, break of 2470.72 will risk deeper pull back to 55 D EMA (now at 2412.87) first.

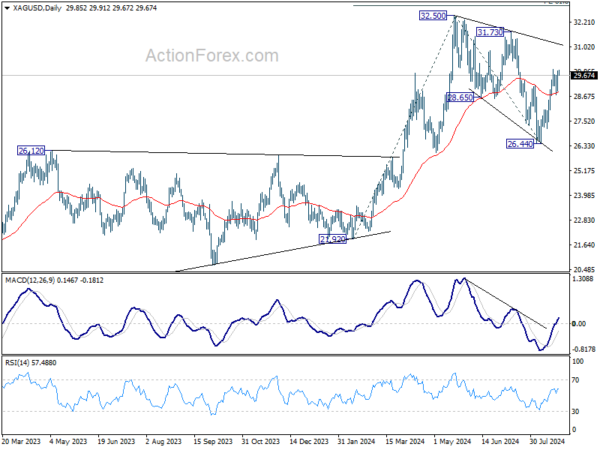

While Silver has been lagging Gold in its run, there is prospect of a catch up ahead. Corrective pattern from 32.50 has likely completed with three waves down to 26.44, after defending 26.12 resistance turned support. For now, further rise is in favor as long as 28.76 support holds. Break of 29.94 will target 31.73 resistance. Decisive break there will solidify this view and target 32.50 and above. However, break of 28.76 will dampen this immediate bullish case.