In an unexpected move, RBNZ lowered its Official Cash Rate by 25bps to 5.25% today, catching markets off guard. The central bank also unveiled new economic projections, which indicate the possibility of another rate cut later this year, followed by a total of 100bps in cuts throughout 2025.

RBNZ emphasized that the “pace of further easing” will hinge on confidence that pricing behavior remains aligned with a low-inflation environment and that inflation expectations stay anchored around the 2% target.

The minutes of the meeting reveal that “recent indicators give confidence that inflation will return sustainably to target within a reasonable time frame.” The Committee agreed that with headline CPI inflation expected to return to the target band by the September quarter and growing excess capacity supporting a continued decline in domestic inflation, there was room to “temper the extent of monetary policy restraint.”

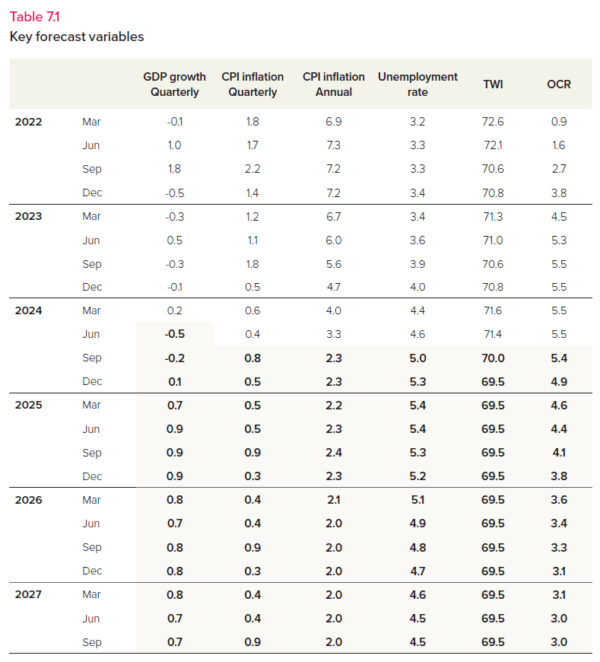

The new economic projections suggest that OCR could drop further to 4.9% by Q4 2024, 3.8% by the end of 2025, and eventually reach 3.0% by mid-2027. Annual CPI inflation is forecasted to hover between 2.2% and 2.4% before settling at 2.0% by Q2 2026.