Japan confirmed its intervention in the currency market last month following Yen’s drop to a 38-year low against Dollar. This intervention marked the turning point for Yen’s massive month-long rally, which continues this week following BoJ’s second interest rate hike this year. Governor Kazuo Ueda has indicated that further tightening remains a possibility.

The Japanese Ministry of Finance disclosed on Wednesday that authorities spent JPY 5.53T, or USD 36.8B, on market intervention between June 27 and July 29. This amount aligns with market expectations and underscores the significant effort to stabilize the yen.

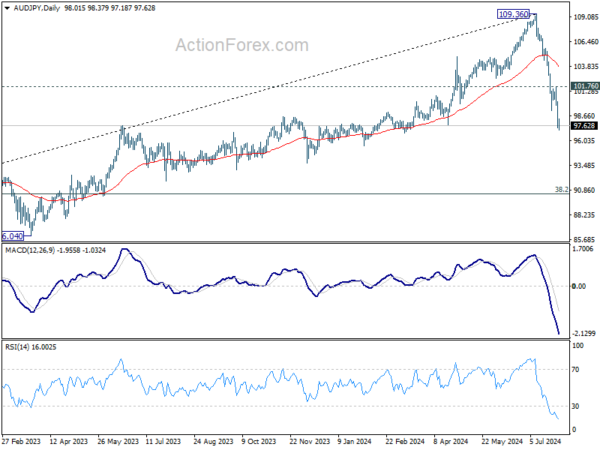

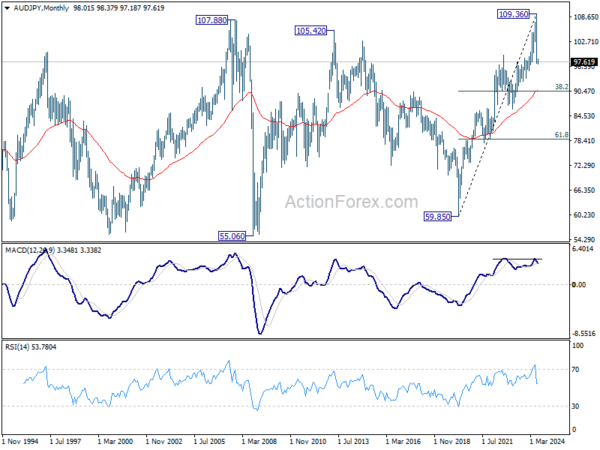

The AUD/JPY pair has been one of the biggest losers, dropping more than 3% this week alone. Technically, the near-term outlook remains bearish as long as the 101.76 resistance holds, even if there is a rebound. The fall from 109.36 is viewed as a correction to the uptrend that started from the 2020 low of 59.85. A deeper decline is anticipated towards the 38.2% retracement level of 59.85 to 109.36 at 90.44. Strong support is likely at this level, considering its proximity to the 55-month EMA (currently at 90.83) and the psychological 90 level, which could provide a floor to the downside on the first attempt.