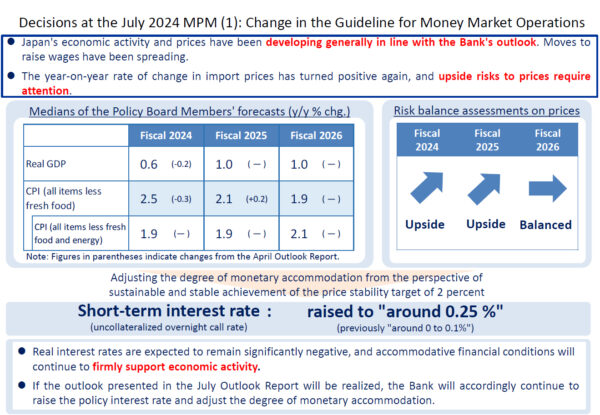

BoJ raised the uncollateralized overnight call rate from 0-0.10% to around 0.25% today. The decision was made by a 7-2 vote, with dissenting votes from Toyoaki Nakamura and Asahi Noguchi, who preferred to gather more information and conduct a careful assessment before adjusting the interest rate.

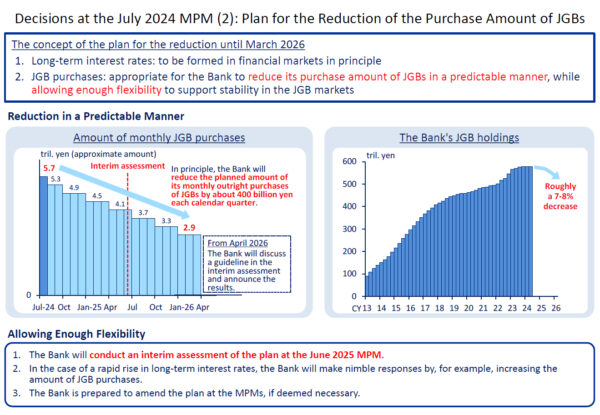

Regarding JGB purchases, there was a unanimous decision to reduce the amount of monthly outright purchases to about JPY 3T by Q1 2026. The amount will be cut by JPY 400B each calendar quarter.

BoJ stated that economic activity and prices have been “developing generally in line with the Bank’s outlook.” Moves to raise wages have been spreading, and the annual rate of import price growth has “turned positive again,” with upside risks to prices requiring attention.

It also noted if the outlook presented in the July Outlook Report is realized, BoJ will continue to raise the policy interest rate and adjust the degree of monetary accommodation accordingly.

In the new economic projections, the BoJ made several adjustments:

- Fiscal 2024 growth forecast was lowered from 0.8% to 0.6%.

- Fiscal 2025 growth forecast remains unchanged at 1.0%.

- Fiscal 2026 growth forecast remains unchanged at 1.0%.

For inflation projections:

- Fiscal 2024 CPI core forecast was lowered from 2.8% to 2.5%.

- Fiscal 2025 CPI core forecast was raised from 1.9% to 2.1%.

- Fiscal 2026 CPI core forecast remains unchanged at 1.9%.

- Fiscal 2024 CPI core-core forecast remains unchanged at 1.9%.

- Fiscal 2025 CPI core-core forecast remains unchanged at 1.9%.

- Fiscal 2026 CPI core-core forecast remains unchanged at 2.1%.