Australian Dollar continues to face significant headwinds, largely due to ongoing worries about the Chinese economy—the most significant trading partner. Despite the possibility of RBA raising interest rates while other global central banks are adopting easing policies, this potential policy divergence is currently providing little support for the Aussie. Market focus has shifted away from these interest rate considerations, at last for the time being.

Recent developments, including China’s Third Plenum last week, have left investors disappointed due to the lack of substantial measures announced to revitalize the slowing Chinese economy, currently grappling with deflation risks and a troubled housing market. The People’s Bank of China’s unexpected rate cut yesterday, although aimed at addressing these issues, was perceived as too modest to make a significant impact.

Adding to the complexity is the uncertainty surrounding the upcoming US presidential election. Overnight reactions in the US stock market to Joe Biden’s withdrawal from the presidential race—and Kamala Harris stepping in as the Democratic candidate—were initially positive. However, the realistic possibility of Donald Trump securing a victory poses concerns, particularly regarding his trade tariff policies, which could exacerbate the economic slowdown in China

AUD/CAD’s decline starkly illustrates that interest rate policies are not the primary driver for the Aussie at this time. With BoC’s anticipated rate cut this week and uncertainty over whether RBA might hike rates again, the currency pair should theoretically have more room to rally. But the cross has indeed turned south.

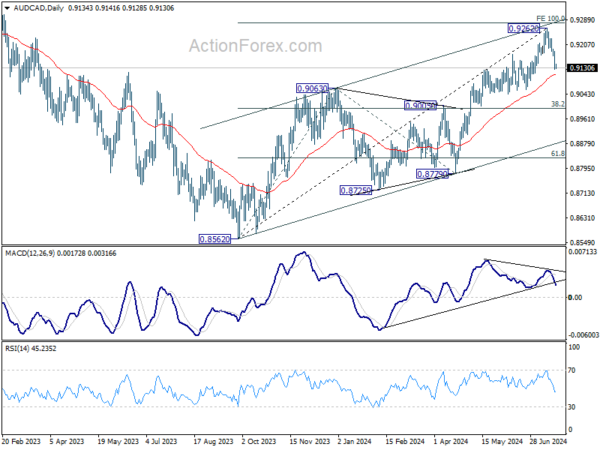

Technically, considering bearish divergence condition in D MACD, a medium term top could have been formed at 0.9262, just ahead of 100% projection of 0.8562 to 0.9063 from 0.8779 at 0.9280. Near term focus is on 55 D EMA (now at 0.9108). Decisive break there would at least send AUD/CAD to 38.2% retracement of 0.8562 to 0.9262 at 0.8995, with risk of further fall to channel support (now at 0.8872).