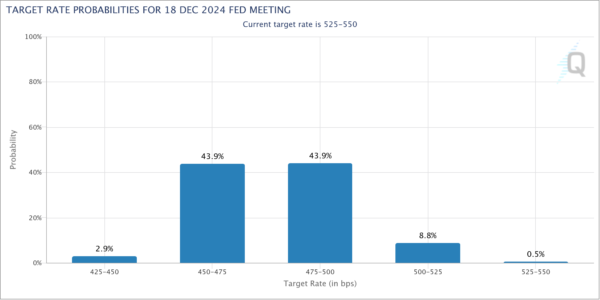

Several Federal Reserve officials welcomed the US June CPI data released yesterday, which showed better-than-expected disinflation progress. This has intensified expectations that Fed would start cutting interest rates in September, with Fed fund futures indicating a 93% chance. More importantly, there is now over 90% probability of two rate cuts by the end of the year, lowering rates to 4.75-5.00%.

Chicago Fed President Austan Goolsbee described the latest inflation data as “excellent,” noting the significant deceleration in shelter inflation as “profoundly encouraging.” He added that “this is what the path to 2% looks like.”

St. Louis Fed President Alberto Musalem also saw the June CPI data as “encouraging further progress toward lower inflation.” He emphasized the need for greater confidence that inflation will converge to 2% before lowering rates. Musalem noted the importance of seeing a moderation in demand and data that shows inflation converging to 2% by mid to late next year, adding, “we’re on a good path.”

San Francisco Fed President Mary Daly highlighted the broader economic context, saying, “With the information we have received today, which includes data on employment, inflation, GDP growth, and the outlook for the economy, I see it as likely that some policy adjustments will be warranted.” However, she noted that the timing of these adjustments is still uncertain.