Eurozone’s PMI data for June revealed significant declines, with Manufacturing PMI falling from 47.3 to 45.6, below the expected 45.6. Services PMI also dropped from 53.2 to 52.6, missing the forecast of 53.5. Consequently, Composite PMI decreased from 52.2 to 48.0.

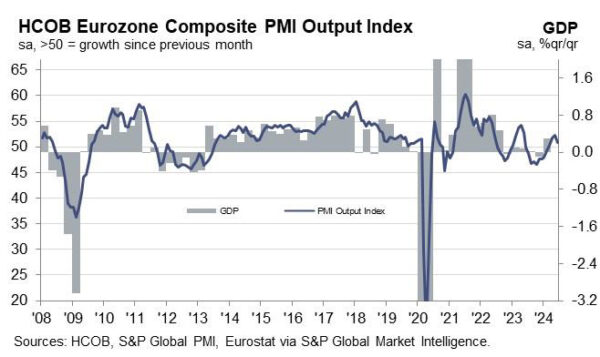

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted that the preliminary HCOB Flash Eurozone Composite Output Index indicates a slight downgrade in GDP growth for Q2, though it still suggests positive growth of 0.2% compared to Q1.

ECB’s June rate cut may be justified by easing price pressures in the service sector, he added. However, the PMI data do not support another rate cut in July. In Germany, service providers increased their prices more sharply than in May. Additionally, the manufacturing sector, which faced deflation in output charges for 14 months, saw input prices rise in June for the first time since February 2023.

He also noted that orsening conditions in France’s services and manufacturing sectors may be tied to recent European Parliament election results and President Macron’s announcement of snap elections on June 30. This uncertainty has likely led many companies to pause new investments and orders, contributing to the economic downturn in the Eurozone.

German PMI Manfacturing fell from 45.4 to 43.4. PMI Services fell from 54.2 to 53.5. PMI Composite fell from 52.4 to 50.6. French PMI Manufacturing fell from 46.4 to 45.3. PMI Services fell from 49.3 to 48.8. PMI Composite fell from 48.9 to 48.2.