Euro spiked sharply lower in thin Asian session today, breaking a crucial support level against Sterling. This decline was sparked by the results of European Parliament elections, where Eurosceptic nationalists made notable gains, although the Centre, liberal, and Socialist parties are still expected to hold a majority.

The election outcomes prompted a dramatic response from French President Emmanuel Macron, who called for a parliamentary election with the first round set for June 30. This move gives the far-right an opportunity to gain substantial political power, potentially weakening Macron’s presidency three years ahead of its end. In Germany, Chancellor Olaf Scholz’s Social Democrats experienced their worst electoral result ever, losing ground to both mainstream conservatives and the hard-right Alternative for Germany.

The announcement of snap elections in France introduces significant uncertainty for the EU, likely impacting economic and market confidence, particularly in France.

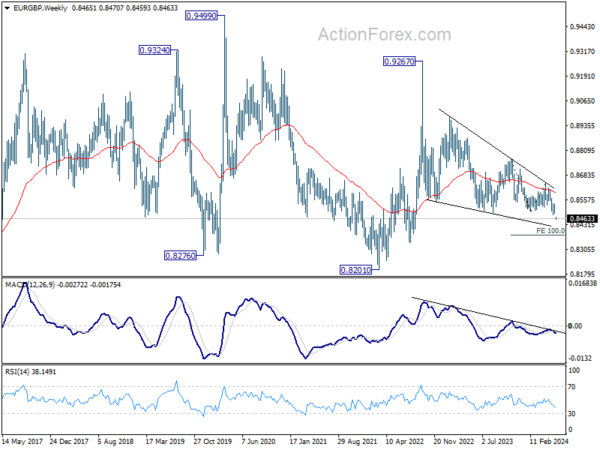

Technically, EUR/GBP’s strong break of 0.8491 support confirms resumption of whole down trend from 0.9267 (2022 high) Outlook will stay bearish as long as 0.8529 resistance holds. Next target is 100% projection of 0.8764 to 0.8497 from 0.8643 at 0.8376.

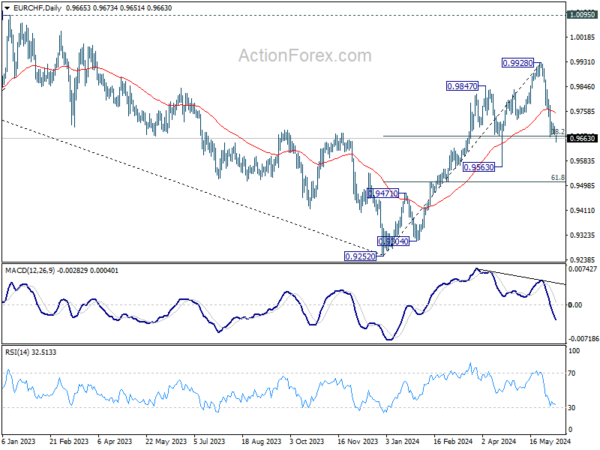

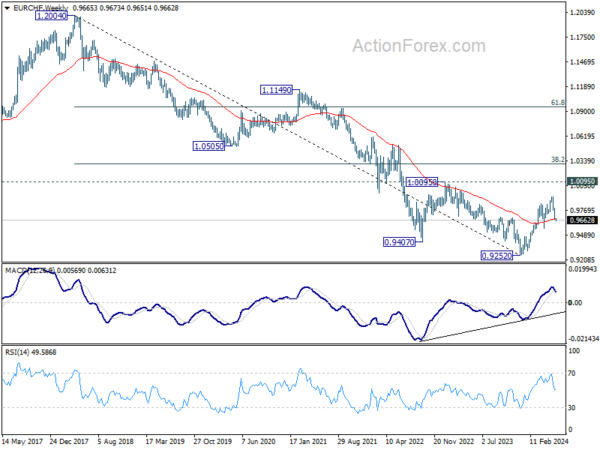

As for EUR/CHF, sustained trading below 38.2% retracement of 0.9252 to 0.9928 at 0.9670 and 55W EMA (now at 0.9672) will raise the chance that whole rise from has completed at 0.9928 already. Deeper decline would be seen to 0.9563 support first. Further break there will strengthen this bearish case.