US 10-year Treasury yield dropped significantly overnight, marking its most substantial one-day decline since last December. This sharp fall was triggered by disappointing economic data, revealing contraction in manufacturing activity for the second consecutive month. This indication of a cooling economy lifted optimism among investors slightly, as Fed would still be on track for monetary policy easing this year.

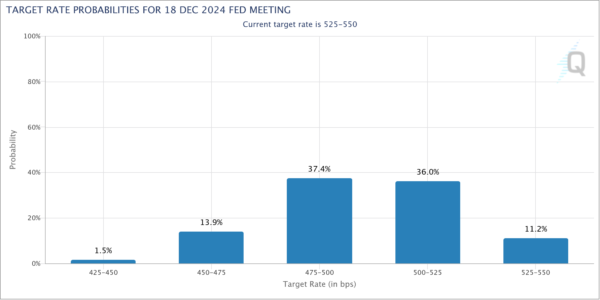

Currently, the probability of an initial rate cut in September has climbed to nearly 60%, according to Fed fund futures. Furthermore, expectations for a total of two rate cuts by year-end have also increased, now standing at 52.8%. However, these speculations could see dramatic shifts depending on the outcomes of upcoming economic reports, including ISM services data and non-farm payroll figures later this week.

Technically, as long as 4.318 support holds, 10-year yield’s rebound from 3.780 is still in favor to extend through 4.730 at a later stage. However, as this rise is seen as the second leg of the corrective pattern from 4.997, strong resistance should be seen below there to limit upside. Sustained break of 4.318 will indicate near term reversal, and turn outlook bearish.