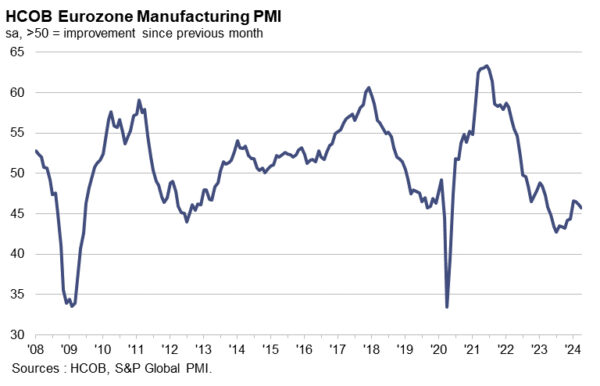

Eurozone’s manufacturing sector remains entrenched in recession as April’s PMI figures highlight ongoing challenges and disparities within the region. The overall Manufacturing PMI for the Eurozone was finalized at 45.7, a slight decrease from March’s 46.1.

Among the member states, Greece led with a PMI of 55.2, though it marked a three-month low for the country. Spain and the Netherlands exhibited positive trends, with Spain reaching a 22-month high at 52.2 and the Netherlands achieving a 20-month high at 51.3. Conversely, major economies like Germany, France, and Italy continued to struggle. Germany’s PMI slightly improved to a two-month high of 42.5, and France’s was a three-month low at 45.3, despite a slight uptick from the flash estimate.

Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, noted the manufacturing sector is prolonging its drawn-out recession into April.” He highlighted the significant downturn in new orders, which he described as “a rapid decline unmatched in speed over the past four months and devoid of international support.” De la Rubia also pointed out the concerning trends in the capital goods sector, which is usually a bellwether for broader industrial health but has been “hit particularly hard” in the current cycle.

Spain stands out as an anomaly within the Eurozone, continuing to demonstrate economic resilience with sustained growth in its manufacturing sector. This divergence is notable, especially against the backdrop of more subdued economic performances in other major Eurozone economies like Germany, France, and Italy, which have failed to gain similar momentum.