Bets on a Fed rate cut in June receded sharply following yesterday’s stronger than expected US CPI report. The drastic shift in sentiment led to steep decline in DOW and strong rally in Dollar index. FOMC minutes further cemented this outlook, revealing Fed’s cautious stance on interest policy easing and its desire for more evidence of disinflation progress before considering rate cuts.

The March FOMC minutes highlighted a consensus among members regarding the “uncertainty” surrounding the “persistence of high inflation”. Recent economic data did little to assuage these concerns, failing to increase the Committee’s confidence that inflation was on a steady decline toward 2% target.

The minutes further detailed concerns over the “relatively broad based” nature of recent inflation increases, cautioning against dismissing these trends as mere statistical outliers. This characteristic led to a consensus that these developments should not be hastily dismissed as “merely statistical aberrations.”

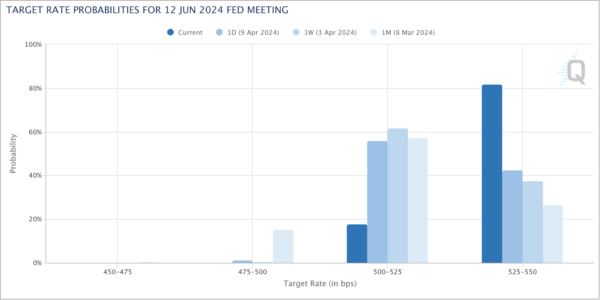

Fed fund futures are now pricing in just 18% chance of a Fed rate cut in June, comparing to 58% a day ago.

DOW closed down -422 pts or -1.09% at 38461.51. Technically, the break of 38483.25 support and 55 D EMA suggest that rise from 32327.20 has completed at 39899.05, on bearish divergence conditions in D MACD. Deeper correction is in favor to 38.2% retracement of 32327.20 to 39899.05 at 37000.42.

Dollar Index surged sharply to close at 105.24. Break of 150.10 resistance indicates resumption of whole rally from 100.61. Also, the strong support from 55 D EMA is a clear near term bullish sign. Further rally is now expected as long as 103.93 support holds. Next target is 100% projection of 100.61 to 104.97 from 102.35 at 106.71.