US Treasury yields surged overnight and pulled Dollar higher, in reaction to February’s stronger than expected PPI data. Despite prevailing expectations for the Fed to initiate rate cuts in June, the persistence of “sticky” inflation has led a reassessment of the loosening path throughout the year.

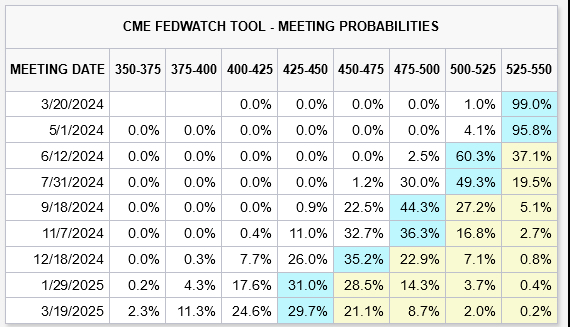

Currently, Fed fund futures reflect diminished confidence, with the likelihood of three rate cuts by year-end, from current 5.25-5.50% down to 4.25-4.50%, falling below 70%. Some market participants appears to be speculating on a less dovish stance in Fed’s updated dot plot, set to be unveiled next week.

Technically, 10-year yield’s strong rise overnight suggests that corrective rebound from 3.785 is still in progress. Break of 4.354 is possible. But for now, strong resistance is expected between 4.391 ad 4.534 (50% and 61.8% retracement of 4.997 to 3.785) to limit upside to complete the rebound.