New Zealand Dollar rises broadly today, buoyed by ANZ’s forecast that RBNZ is set to increase the official cash rate in its upcoming meetings on February 22 and again in April, elevating interest rate to 6%.

ANZ’s chief economist, Sharon Zollner, highlighted RBNZ’s November warning that stronger-than-expected inflation pressures would necessitate further increases in the OCR.

“Data since then has been a series of small but pretty consistent surprises in that direction,” Zollner noted. The economist further elaborated that the cumulative effect of these data surprises, though individually not game-changers, collectively strengthens the argument for the RBNZ to proceed with rate increases.

“Indeed, their OCR forecast peak of 5.69% implied that the burden of proof was now on finding reasons not to hike, strictly speaking,” Zollner added.

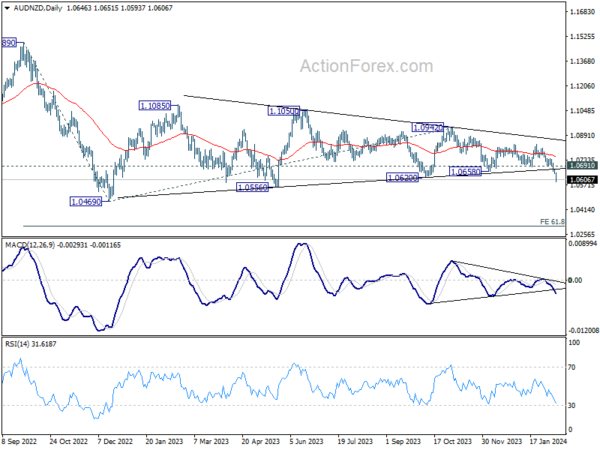

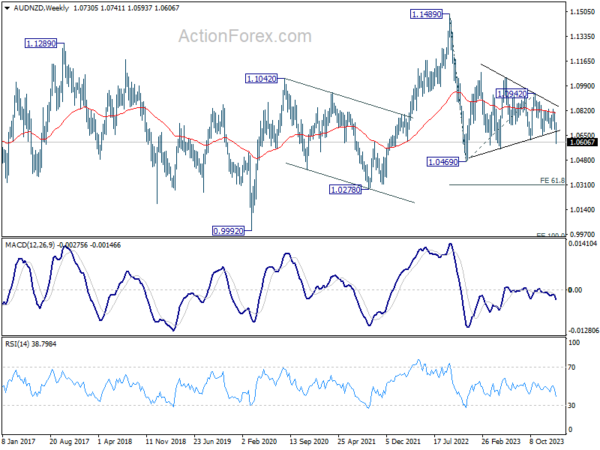

In the currency markets, AUD/NZD’s steep decline and strong break of 1.0658 support affirms the bearish case that consolidation from 1.0469 has completed at 1.0942 already. Outlook will stay bearish as long as 1.0691 support turned resistance holds. Next target is retest of 1.0469 (2022 low).

Decisive break of 1.0469 will resume whole down trend from 1.1489 (2022 high), and pave the way to 61.8% projection of 1.1489 to 1.0469 from 1.0942 at 1.0312 in the medium term.