Expectations are firmly set for BoE to keep interest rate unchanged at 5.25% today, marking the fourth consecutive session without a change. Several crucial factors could inject volatility into the financial markets, including the vote split, updated economic projections, and guidance.

A critical aspect to watch is the voting pattern among the MPC’s nine members. It is unlikely that any member will advocate for an interest rate hike. The central question is whether any members, like known dove Swati Dhingra, will begin to vote for a rate cut.

Another key area of interest lies in the revised economic forecasts. Given recent economic developments, it’s plausible that the growth forecasts may see a notable upgrade, while the near-term inflation outlook could be revised downwards. These changes would come with a lowered condition rate path.

The meeting is also expected to see BoE finally dropping its tightening bias, aligning with the broader global central banking trend. However, BoE would likely try to temper any enthusiasm for imminent rate cuts by emphasizing the necessity of maintaining higher interest rates “for longer.” The central bank would require more evidence of wage growth deceleration before feeling confident enough to reduce rates.

There is a divergence of opinions among economists regarding the timing of the first rate cut, with general consensus fluctuates between May and August of this year. Currently, August is the more probable scenario for the initial cut. However, if today’s meeting leans more dovishly than anticipated, it could tilt the scales in favor of a May cut.

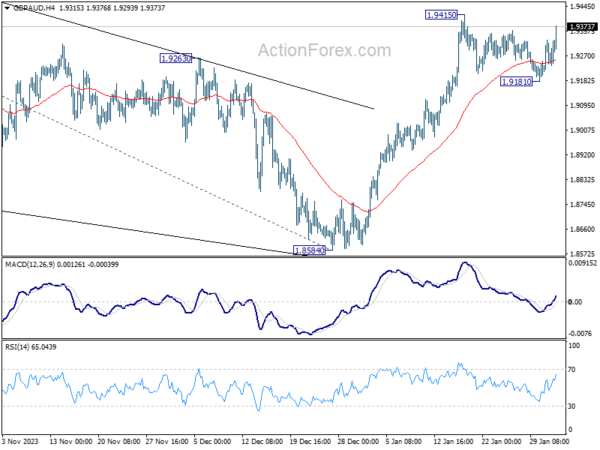

With today’s strong bounce, GBP/AUD’s sideway consolidation from 1.9415 appears to have completed at 1.9181 already. Rise from 1.8584 is probably ready to resume. Firm break of 1.9415 will confirm this bullish case. Nevertheless, break of 1.9181 support will dampen this view and mix up the outlook.

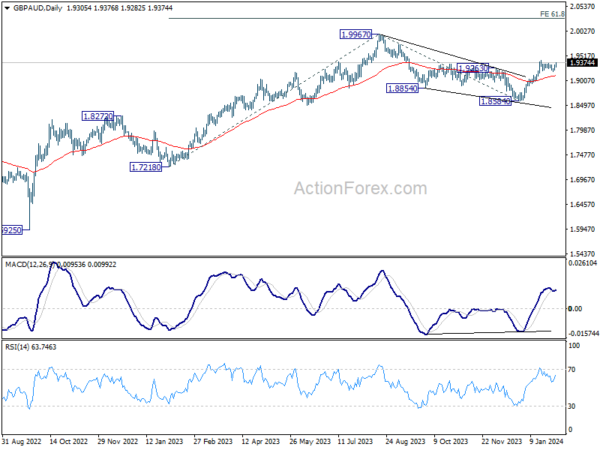

In the bigger picture, corrective pattern from 1.9967 (2023 high) should have completed with three waves down to 1.8584 already. Rise from from there is resuming the long term up trend. Next target is 1.9967 high, with prospect of hitting 61.8% projection of 1.7218 to 1.9967 from 1.8584 at 2.0283.