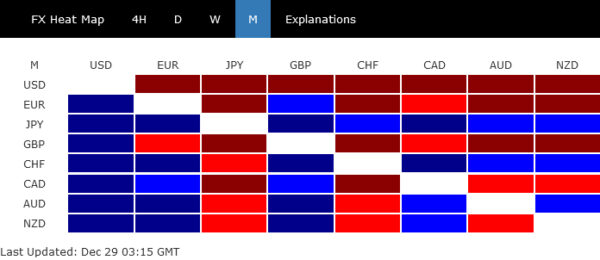

As December 2023 concludes, Dollar is set to be the month’s weakest performer. The persistent selloff can be largely attributed to Fed’s signal of the possibility of implementing rate cuts totaling 75 basis points in the coming year, as seen in latest economic projections. This unexpected pivot towards more accommodative monetary policy had a ripple effect across financial markets, notably propelling DOW to record highs and bringing S&P 500 close to its peak levels.

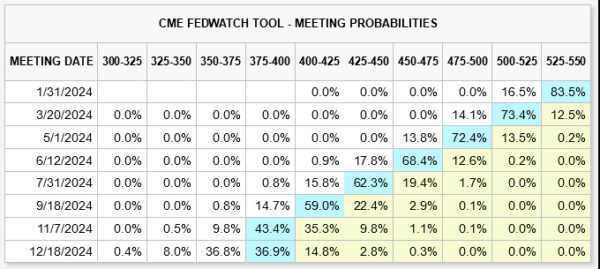

The market’s response to Fed’s policy shift has been markedly aggressive. Traders have priced in an 88% probability of a 25bps cut as soon as March. Looking ahead to the entirety of 2024, there’s a strong consensus, with over an 80% chance, that federal funds rate could decrease to a range of 3.75-4.00%, a notable drop from the current rate of 5.25-5.50%. The underlying rationale for such aggressive market expectations centers around the anticipation of recession in the US next year, a scenario that some analysts believe is increasingly likely.

However, it is important to note that Fed is not alone. ECB and BoE are also expected by the markets to commence rate cuts at some point in the next year. Officials from both these institutions continue to resist these market expectations, but their efforts have fallen into deaf ears. Sterling and Euro have emerged as the second and third weakest currencies, respectively, for December.