WTI crude oil fell sharply overnight, breaking 70 psychological level for the first time since June. Further decline is expected in the short-term from technical perspective. But 63/67 support zone is expected to provide a floor to contain this downtrend.

This selloff is driven by several key factors. The primary concern is demand destruction in the fuel market, underscored by EIA reporting a larger-than-expected increase in US gasoline inventories. Additionally, persistent worries about China’s economic health are adding to the bearish sentiment in the oil market. This concern is exacerbated by Moody’s downgrade of China’s A1 rating outlook from stable to negative. Market skepticism regarding the effectiveness of OPEC+’s production cuts also plays a role.

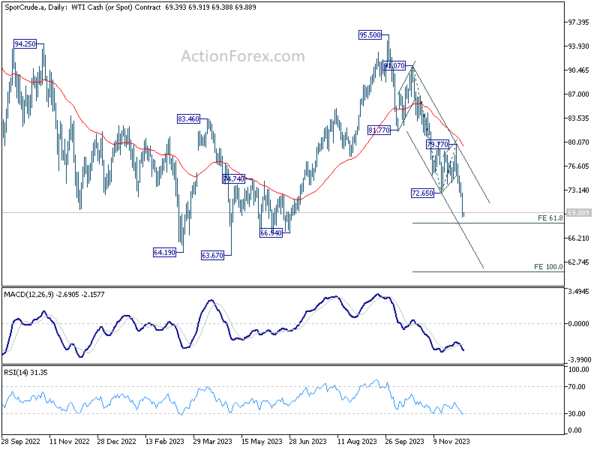

Technically, WTI’s strong break of 72.65 support confirms resumption of the fall from 95.50. Further decline is expected as long as 74.23 resistance holds. Break of 61.8% projection of 91.07 to 72.65 from 79.77 at 68.38 is envisaged.

Strong support is expected from 63.67/66.94 zone to contain downside to complete the five wave sequence from 95.50, and bring sustainable rebound. Even if 63.67 is breached, 100% projection at 61.35 should provide the floor, preventing further substantial drops in oil price.