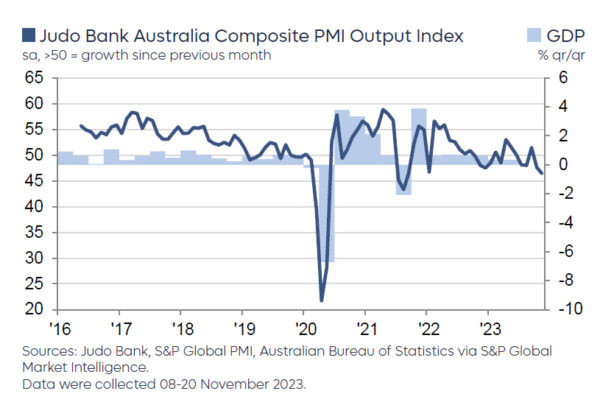

Australia’s manufacturing and services sectors showed continued contraction in November, reaching multi-month lows. PMI Manufacturing index fell from 48.2 to a 42-month low of 47.7, while PMI Services index dropped from 47.9 to a 26-month low of 46.3. PMI Composite also decreased from 47.6 to a 27-month low of 46.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, interpreted these figures as evidence of a further slowdown in Australian economic activity. He commented that the data “all but confirms that the economy is experiencing a soft landing,” aligning with RBA’s expectations. However, Hogan also noted that there are “no real signs of a hard landing” in the survey, indicating a more controlled economic deceleration.

Despite the overall softness in manufacturing, Hogan observed that the sector “does not appear to be slipping into recession” at this stage. Additionally, an improvement in the employment index in the services sector was seen as indicative of “continued strong demand for labour.” This sustained high demand for labour, despite lower activity indexes, points to a persistent imbalance between labour demand and supply.

For RBA, the slowdown in business activity is a welcome development. Still, the strong employment index and an increase in price indexes signal ongoing inflation risks into 2024.

Hogan cautions that it is “still too early to think about rate cuts” in Australia.