BoE held its Bank Rate steady at 5.25%, aligning with broad market anticipations. The decision came with a 6-3 split, with Megan Greene, Jonathan Haskel, and Catherine Mann opting for a 25 basis points increase. The bank emphasized the necessity of maintaining a restrictive monetary stance for an extended period to steer inflation back to its target. They also signaled that should more enduring inflation signs surface, the option for further rate hikes is still on the table.

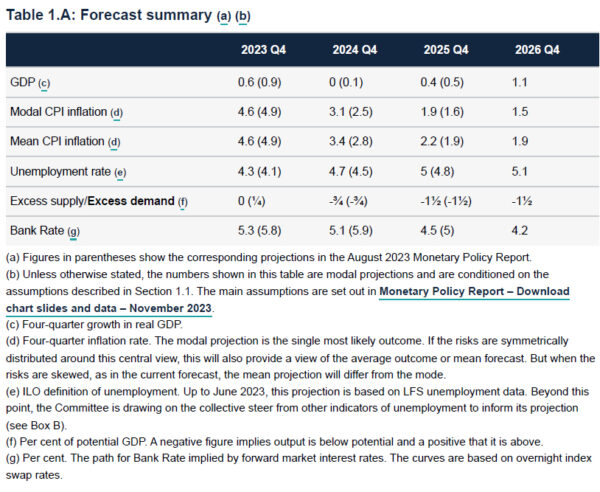

Four-quarter GDP growth:

- Lowered from 0.9% to 0.6% in Q4 2023.

- Lowered from 0.1% to 0.0% in Q4 2024.

- Lowered from 0.5% to 0.4% in Q4 2025.

- At 1.1% in Q4 2026 (new).

Modal CPI inflation:

- Lowered from 4.9% to 4.6% in Q4 2023.

- Raised from 2.5% to 3.1% in Q4 2024.

- Raised from 1.6% to 1.9% in Q4 2025.

- Slow to 1.5% in Q4 2026. (new).

These projections are based on a market-implied path for the Bank Rate that hovers around 5.25% until Q3 2024, and then gradually decreases to 4.25% by the end of 2026.

This represents a lower trajectory compared to the projections in August, which anticipated a Bank Rate of 5.8% by the end of 2023, 5.9% by the end of 2024, and 5% by the end of 2025.