US stock market experienced a robust rebound overnight, with DOW recording its most substantial three-day gain since April, following Fed’s decision to maintain the interest rate at the widely anticipated range of 5.25-5.50%. This marks the second consecutive month of rate pause, but Fed has not ruled out the possibility of further tightening in the future.

Treasury yields witnessed a notable decline across the spectrum, a trend initially sparked by Treasury’s refunding plan. 2-year yield ended the day staying below 5% mark, settling at 4.96%, while 10-year yield broke through 4.8% level. closing at 4.789%.

During the post-meeting press conference, Fed Chair Jerome Powell underscored the flexibility of the FOMC. He emphasized, “The idea that it would be difficult to raise [rates] again after stopping for a meeting or two is just not right. The Committee will always do what it thinks is appropriate at the time.”

Further emphasizing the uncertainty of future meetings, Powell stated, “We have yet to finalize our decisions concerning the upcoming meetings.” He elaborated on the Committee’s objective to assess the need and degree of potential policy tightening, aiming to stabilize inflation at around 2% over a period.

Dismissing any speculations of rate cuts, Powell asserted that such discussions are currently off the table. The primary focus remains on evaluating if the present monetary policy is “sufficiently restrictive” to sustainably bring down inflation to 2% target.

Regarding the balance sheet runoff, Powell mentioned that there is no current consideration to alter its pace. The committee is not discussing or considering any changes in this aspect.

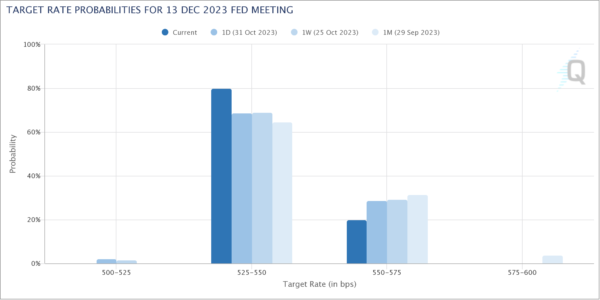

In response to these developments, Fed fund futures indicated a reduced probability of another rate hike in December, now standing at a 20% likelihood, down from the previous day’s 29%.

DOW’s strong rebound this week suggests that a short-term bottom was established at 32327.20 already. Risk is now mildly on the upside for the near term, with possibility of further rally to 55 D EMA (now at 33764.41). If 33764.41 resistance level continues to hold its ground, it could indicate that DOW is merely in a short term consolidation phase, and the decline from 35679.12 might resume at a later stage.

Shifting focus to 10-year yield, corrective pattern from 4.997 extended with yesterday’s fall. Bearish divergence condition in D MACD argues that the consolidation would extend further for a while. . But there is no clear indication of bearish reversal with TNX holding well above 4.532 support as well as 55 D EMA (now at 4.551). Nevertheless, upside potential should be limited for the near term.