Japanese Yen is having notable bounce following emerging reports that BoJ is considering another adjustment to its monetary policy. This potential shift, which may allow 10-year yields to rise above the 1% mark. n official announcement from the central bank is anticipated in the forthcoming Asian trading session.

A report from Nikkei, citing an anonymous source, suggests that BoJ is on the verge of modifying its yield curve control framework. This potential shift aims to facilitate a rise in 10-year Japanese government bond yields beyond the current cap of 1%. It’s important to note that this ceiling was only introduced in July, replacing the previous limit of 0.5%.

The rationale behind this move seems to be twofold. Firstly, BOJ aims to more flexibly conduct its JGB purchase operations. This flexibility, coupled with the revised cap on 10-year yields, appears strategically designed to discourage speculators from pushing the yields to their upper bounds. This tactic could alleviate the pressure on BOJ, reducing the necessity for extensive JGB purchases to maintain rates under 1%.

Another crucial component of the upcoming BoJ announcement will be the bank’s updated forecasts for inflation and economic growth. The central bank is expected to upgrade its projection for core CPI – which excludes fresh food costs – from the present 2.5% for the fiscal term concluding in March 2024 to 1.9% for the subsequent fiscal year.

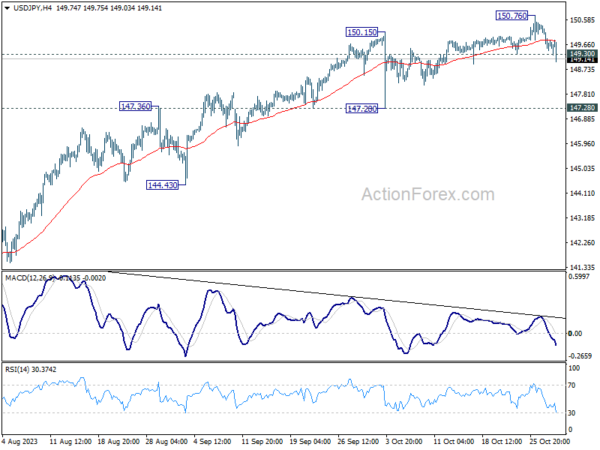

USD/JPY’s break of 149.30 support turns intraday bias to the downside for deeper fall towards 147.28 support. But after all, as long as 147.28 holds, price actions from 150.76 are viewed as a corrective move only. Larger rally would still be in favor to continue at a later stage.