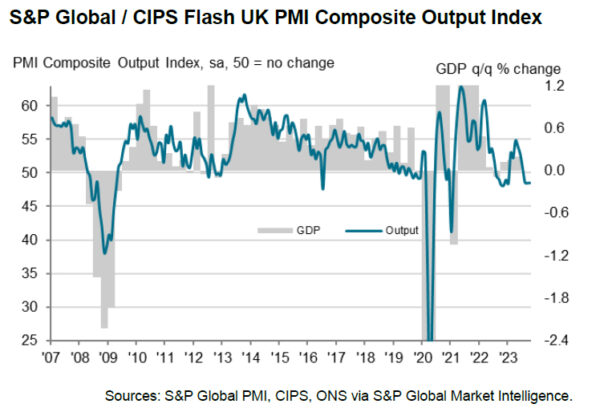

UK PMI Manufacturing saw a modest uptick, moving from 44.3 to 45.2 in October. In contrast, Services sector edged downwards, marking a 9-month low, albeit by a marginal decrement from 49.3 to 49.2. Composite PMI slightly climbed, positioning at 48.6 from a previous 48.5.

According to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, the UK is treading dangerously close to recessionary waters. Williamson highlighted the combined impacts of the rising cost of living, soaring interest rates, and dwindling exports as the chief culprits behind a third consecutive month of diminishing output.

While the rate of economic decline is currently moderate, with predictions hinting at just a -0.1% quarterly GDP drop, the darkening cloud of economic uncertainty suggests tougher times might be ahead. “A recession, albeit only mild at present, cannot be ruled out,” he added.

On a brighter note, the cost pressures evident earlier have started to soften, partly attributed to diminishing wage inflation and decline in prices set by manufacturers. Nonetheless, service sector continues to grapple with inflation, which even saw a slight bump. This indicates that headline inflation might persistently hover around the 4% range as we transition into early next year.

This poses a dilemma for policymakers, especially when factoring in potential inflationary pressures from surging oil prices. “It would be unlikely for policymakers to rule out the possibility of rates rising again later in the year,” he said.